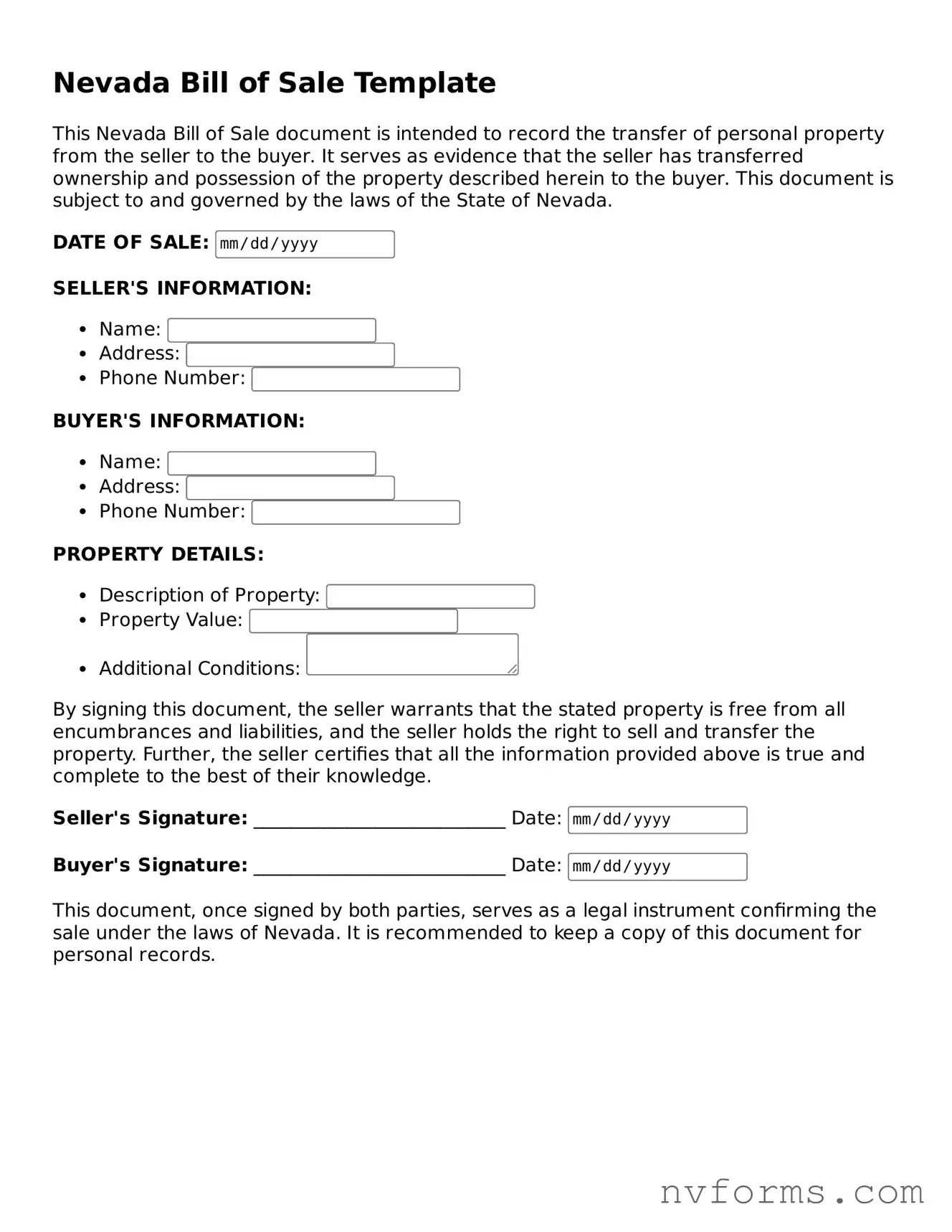

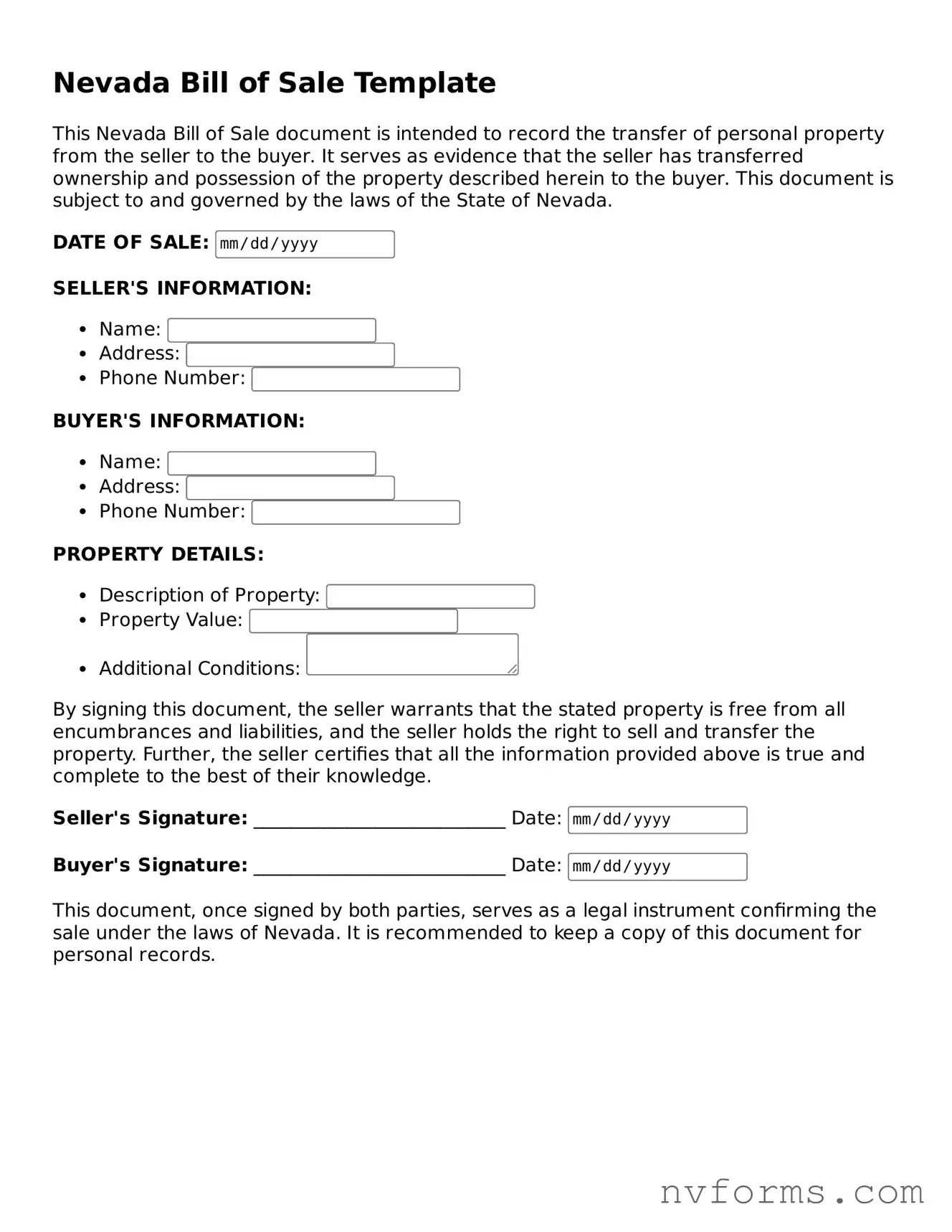

Free Bill of Sale Form for Nevada

A Nevada Bill of Sale form serves as a legal document to prove the transfer of ownership of personal property from one party to another. This document is crucial for both the buyer and the seller, as it provides a record of the transaction details, including the date, sale price, and a description of the item sold. While this form can be used for various types of personal property, it is especially relevant for the sale of vehicles, boats, and other significant assets within Nevada.

Launch Editor

Free Bill of Sale Form for Nevada

Launch Editor

Launch Editor

or

⇩ Bill of Sale File

Don’t stop now — finish the form

Finish Bill of Sale online using an easy step-by-step flow.