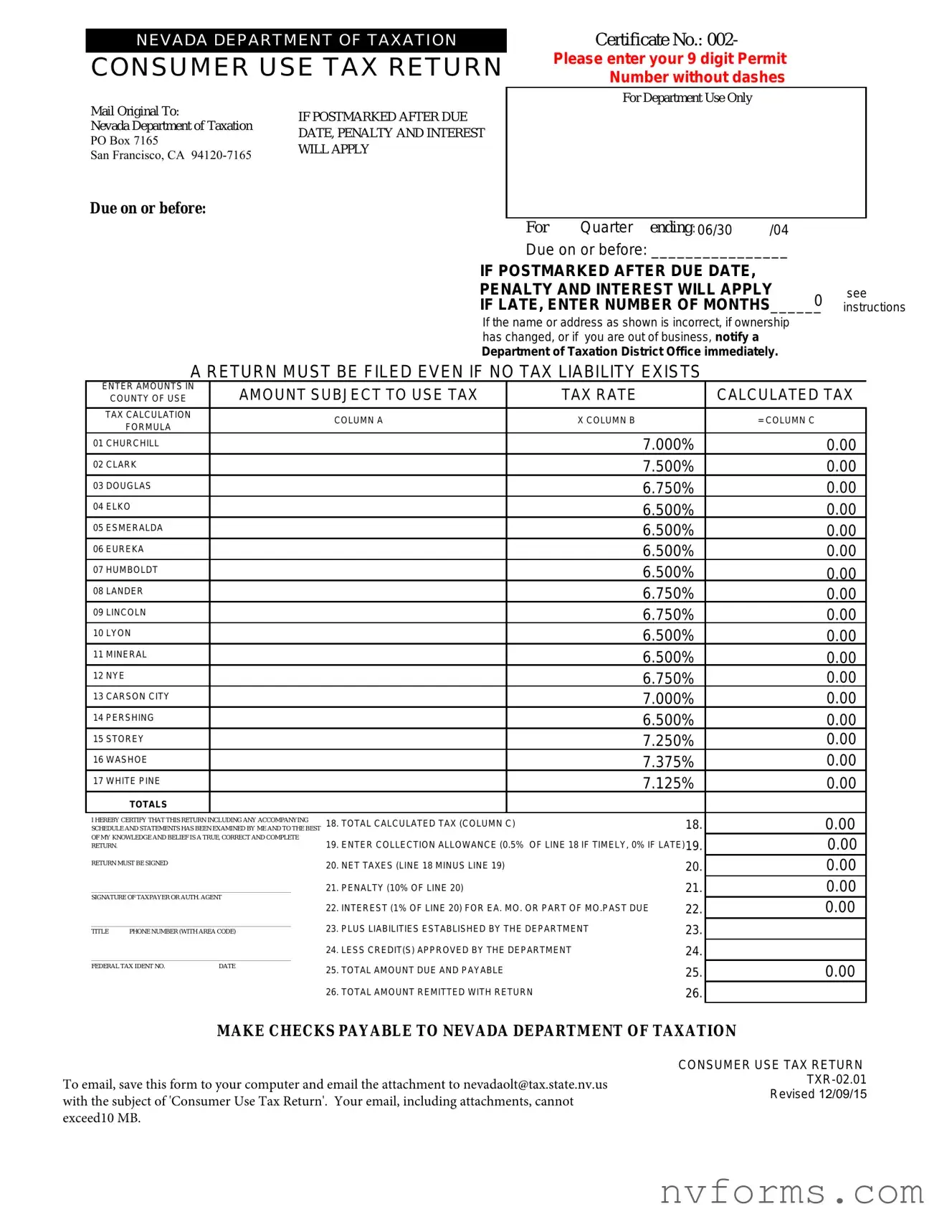

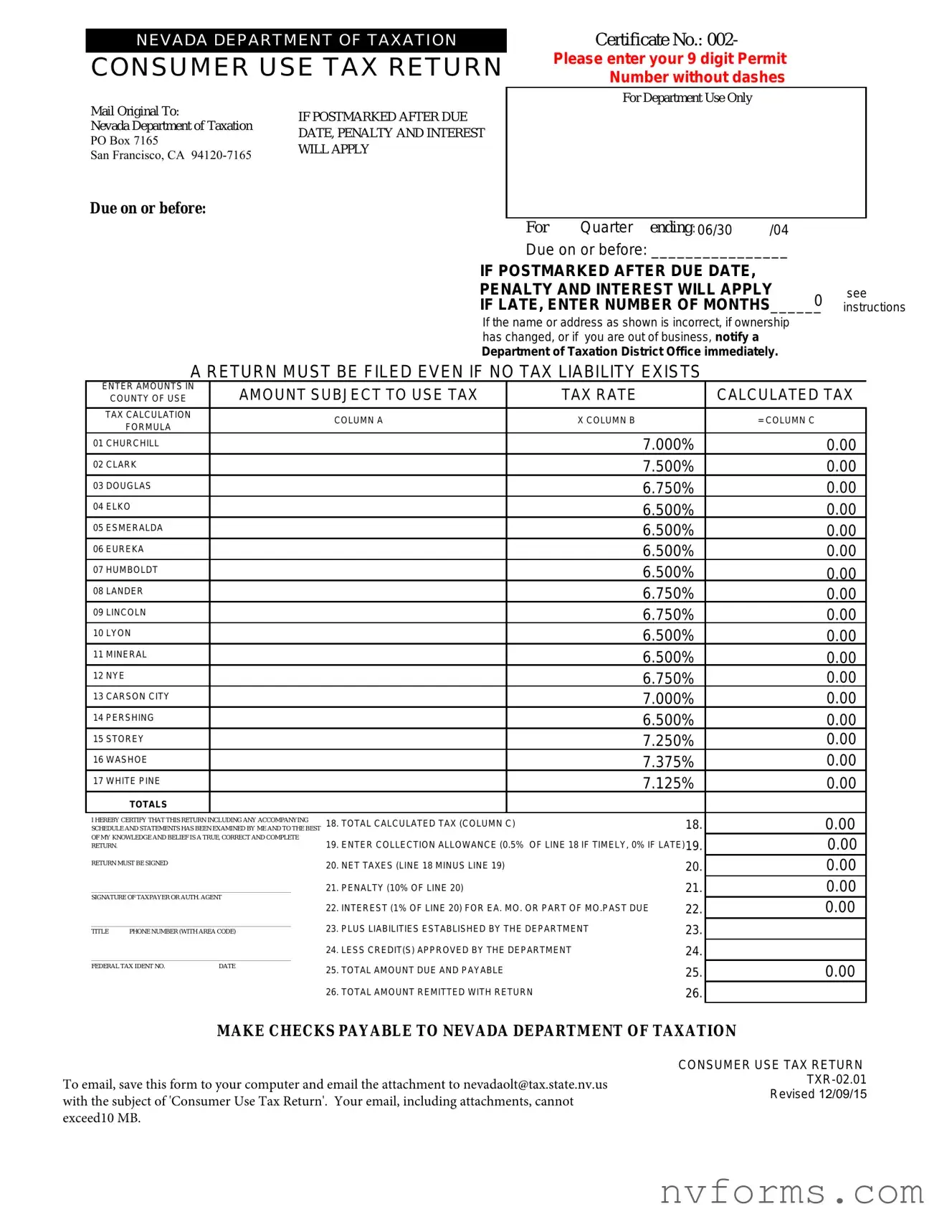

Fill Out a Valid Consumer Use Tax Return Nevada Template

The Consumer Use Tax Return Nevada form, also known as form TXR-02.01, serves as a crucial document for reporting use tax to the Nevada Department of Taxation. This form becomes necessary when tangible personal property, upon which no Nevada sales tax was paid at the time of purchase, is used, stored, or consumed in Nevada, demanding the consumer to self-assess and remit the due tax. Penalties and interest are applied if the form and payment are not postmarked by the due date, emphasizing the importance of timely compliance.

Launch Editor

Fill Out a Valid Consumer Use Tax Return Nevada Template

Launch Editor

Launch Editor

or

⇩ Consumer Use Tax Return Nevada File

Don’t stop now — finish the form

Finish Consumer Use Tax Return Nevada online using an easy step-by-step flow.