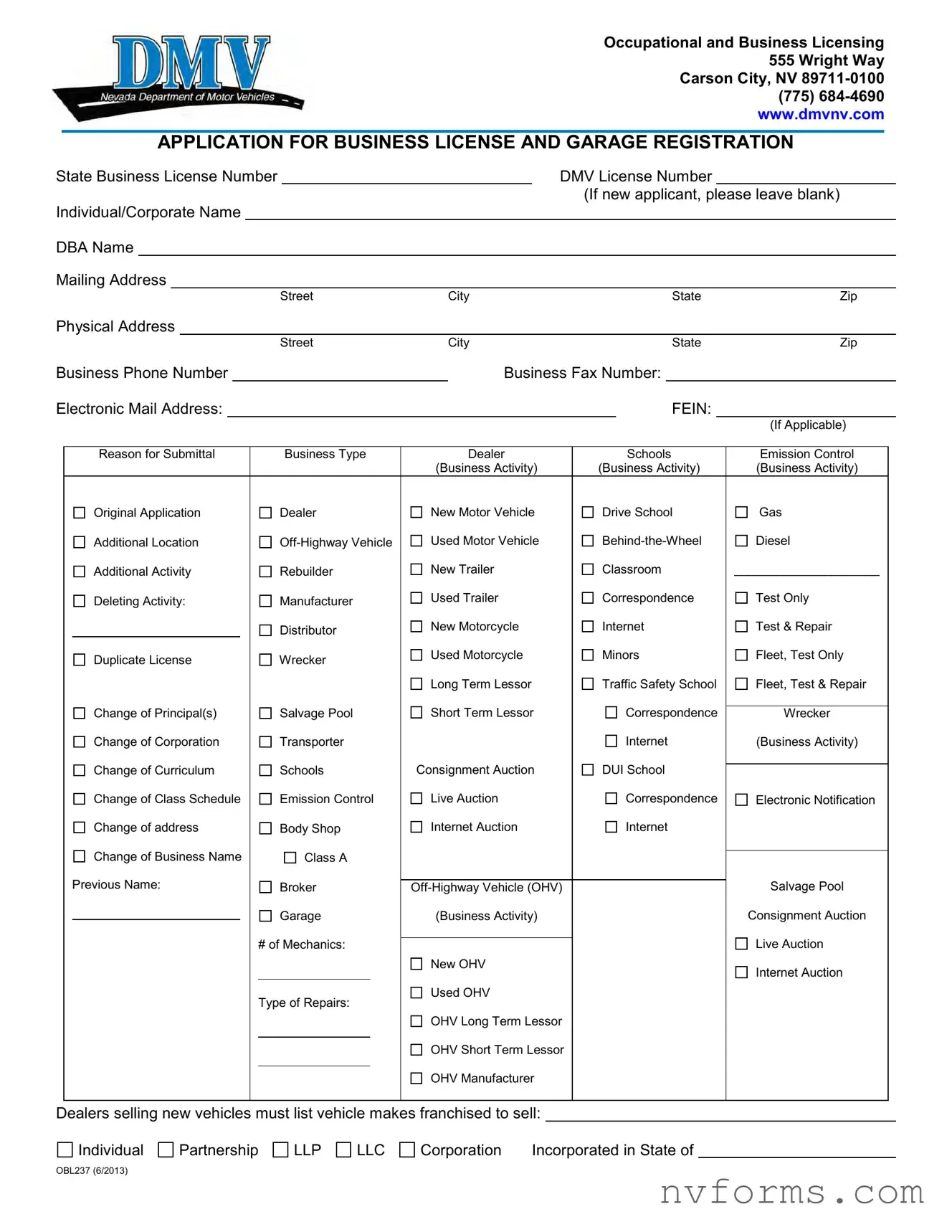

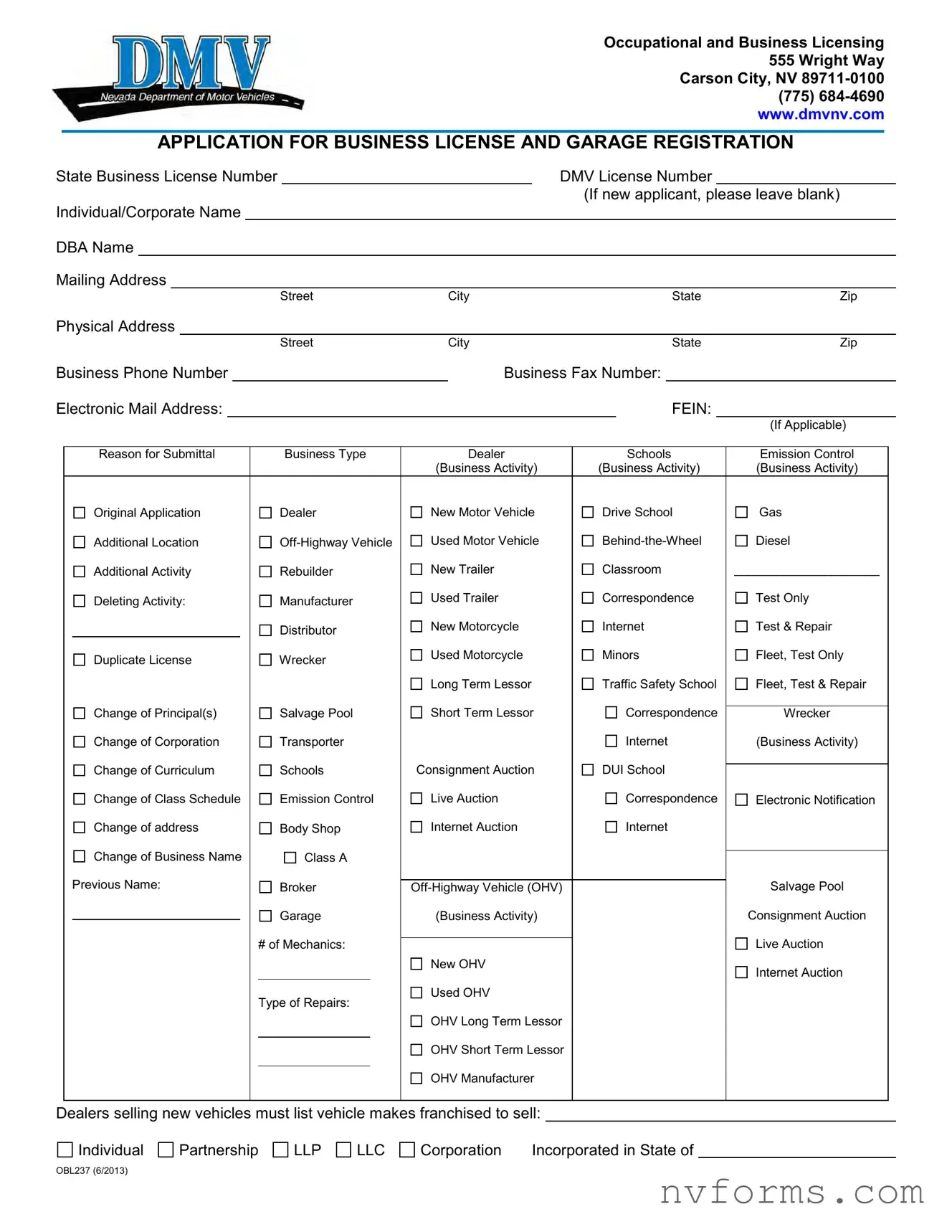

Fill Out a Valid Dmv Obl237 Template

The DMV OBL237 form is a crucial document for those navigating the realms of Occupational and Business Licensing within Carson City, Nevada. It serves a comprehensive purpose, facilitating the application process for various business licenses and garage registrations. This form outlines the necessary details for submission, including the type of business activity, registration for new applicants, and the specifics for those seeking to update or change their current business information.

Launch Editor

Fill Out a Valid Dmv Obl237 Template

Launch Editor

Launch Editor

or

⇩ Dmv Obl237 File

Don’t stop now — finish the form

Finish Dmv Obl237 online using an easy step-by-step flow.