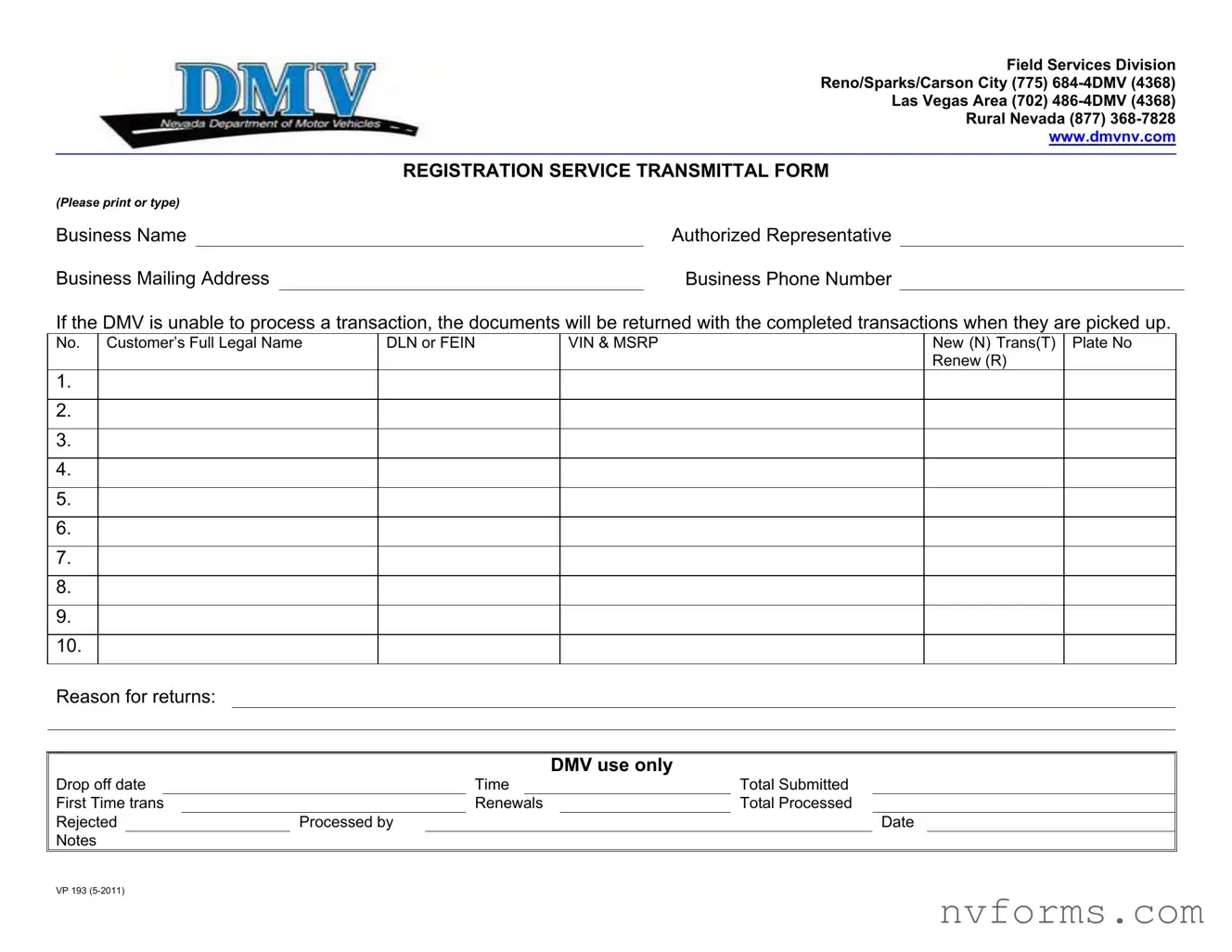

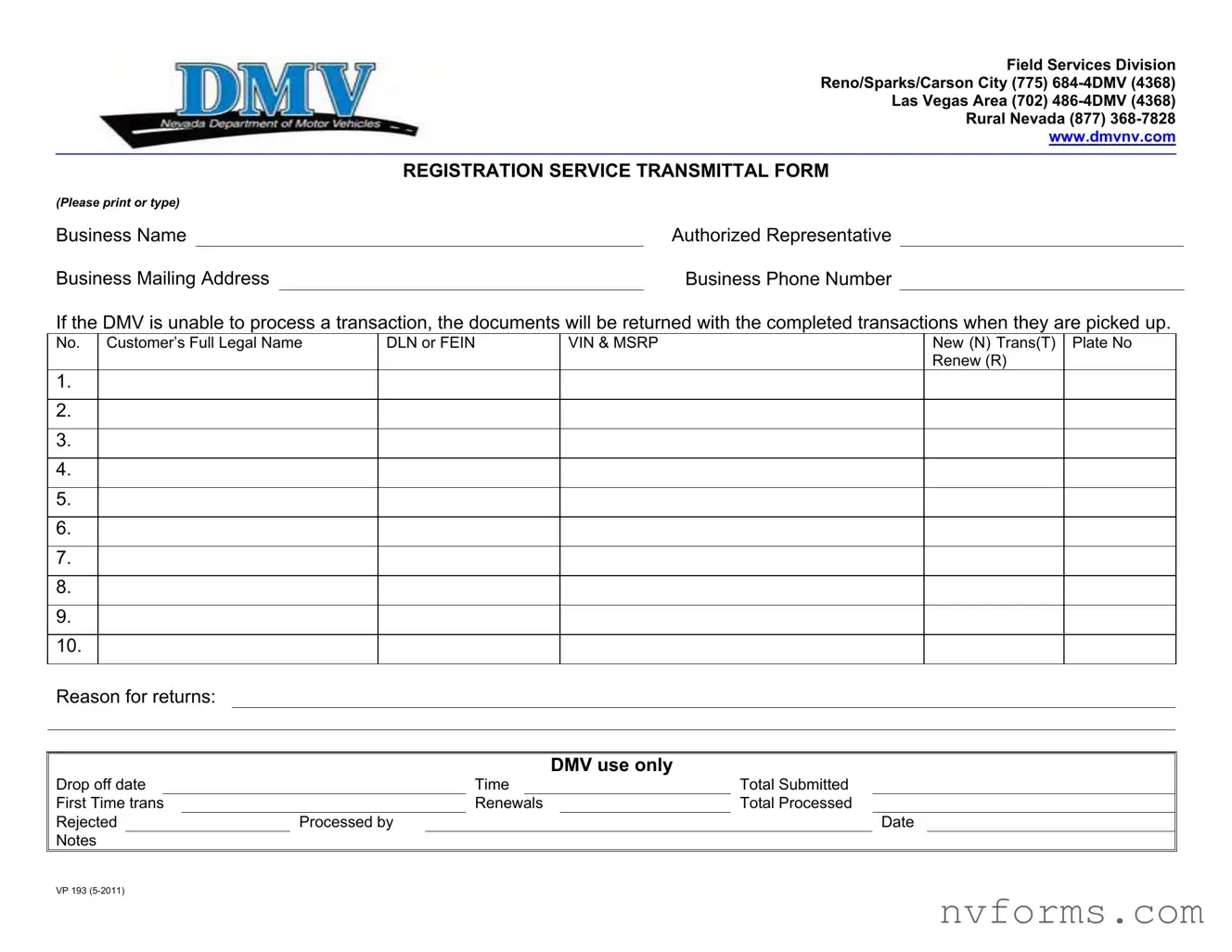

Fill Out a Valid Dmv Vp 193 Template

The DMV VP 193 form serves as a Registration Service Transmittal Form, facilitating communication between businesses and the Department of Motor Vehicles (DMV) across Nevada. Described within, are fields critical for relaying business and vehicle registration details, including business representative information, vehicle identification, and transaction types. This document streamlines the process for submitting vehicle registrations and renewals, while also detailing the procedure for handling documents that cannot be processed.

Launch Editor

Fill Out a Valid Dmv Vp 193 Template

Launch Editor

Launch Editor

or

⇩ Dmv Vp 193 File

Don’t stop now — finish the form

Finish Dmv Vp 193 online using an easy step-by-step flow.