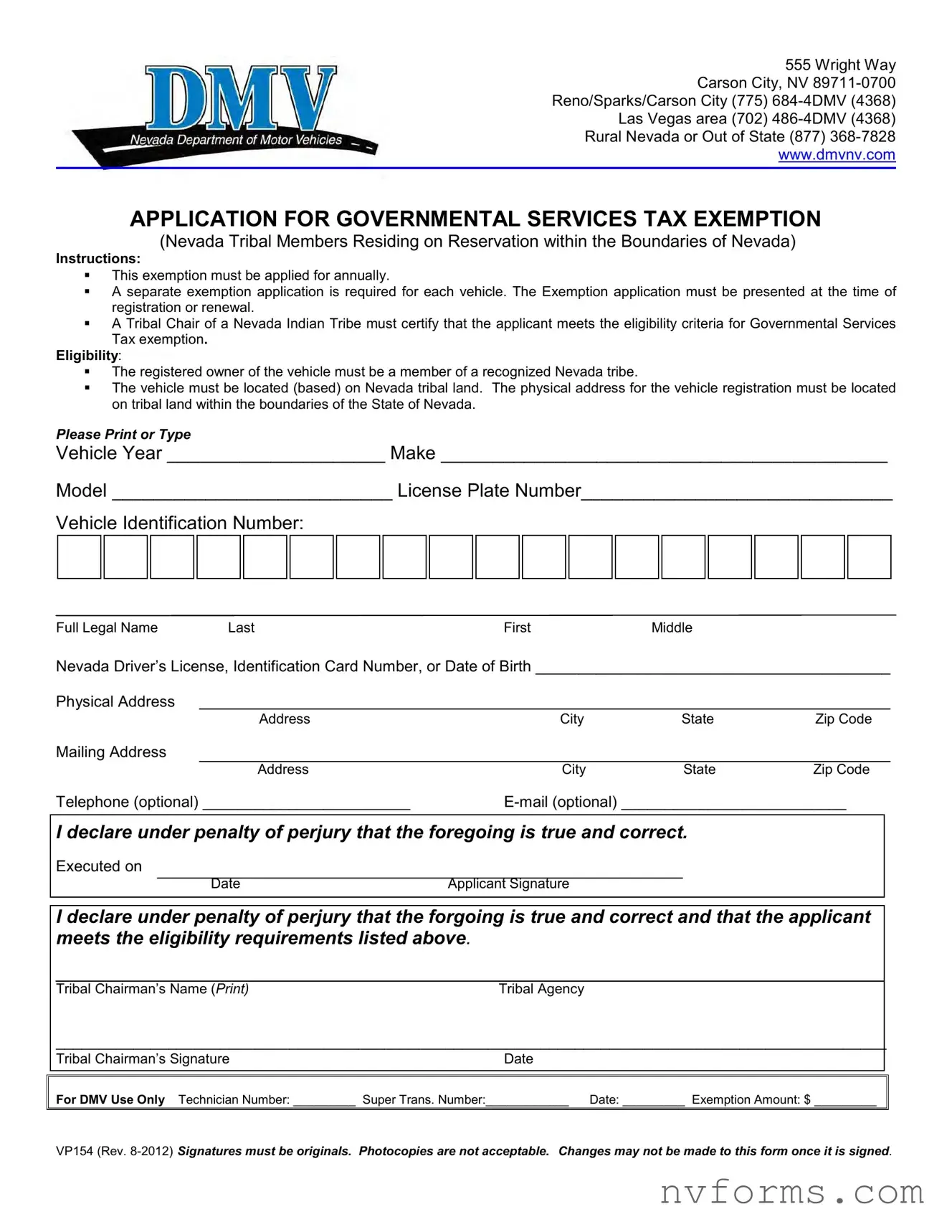

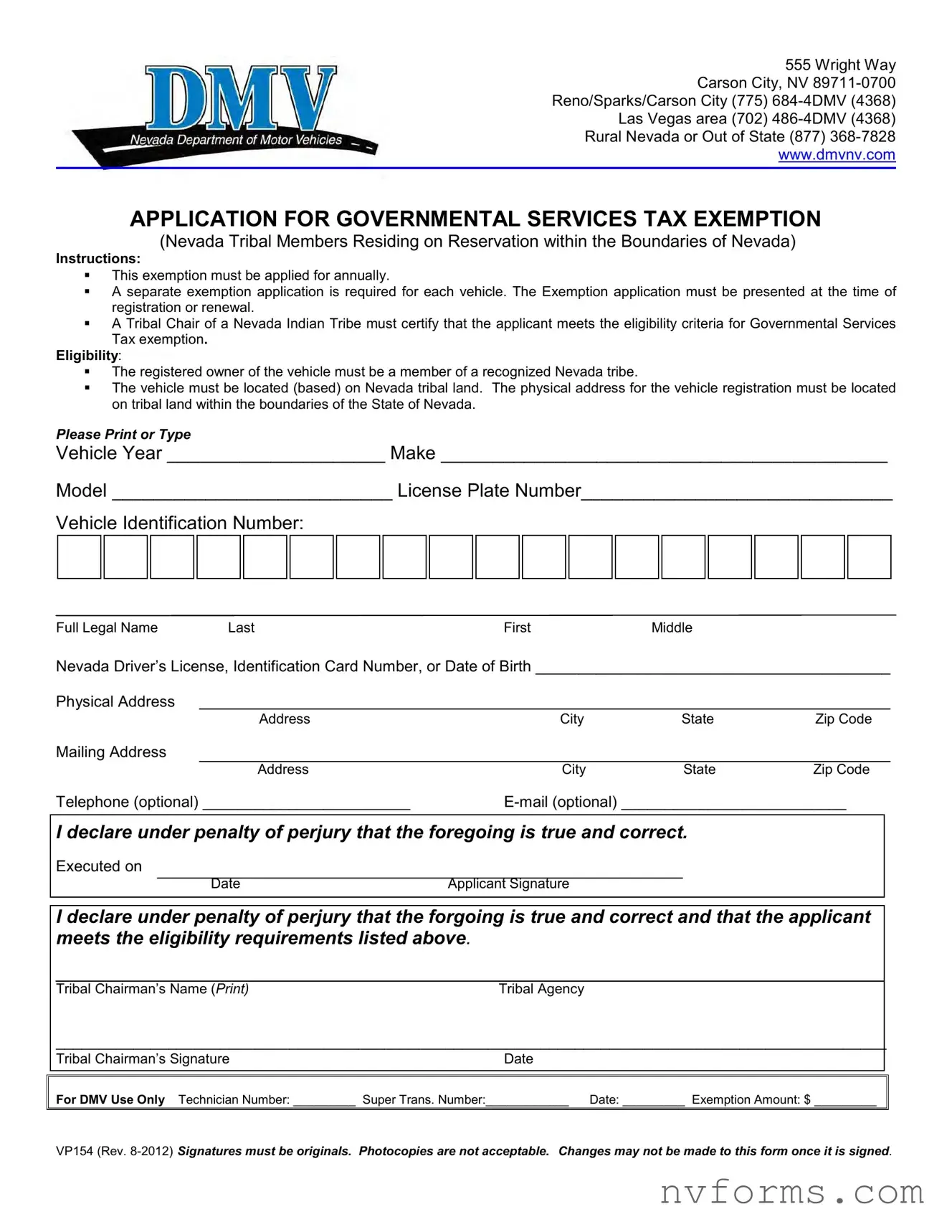

Fill Out a Valid Dmv Vp154 Template

The DMV VP154 form is designed for Nevada Tribal Members residing on a reservation within the state boundaries, offering them a pathway to apply for a Governmental Services Tax Exemption for their vehicles. This exemption necessitates an annual application for each vehicle, requiring certification from a Tribal Chair to confirm the applicant's eligibility. Specifically, it caters to those with vehicles located on Nevada tribal land and mandates the vehicle's registration address to be situated within this designated area.

Launch Editor

Fill Out a Valid Dmv Vp154 Template

Launch Editor

Launch Editor

or

⇩ Dmv Vp154 File

Don’t stop now — finish the form

Finish Dmv Vp154 online using an easy step-by-step flow.