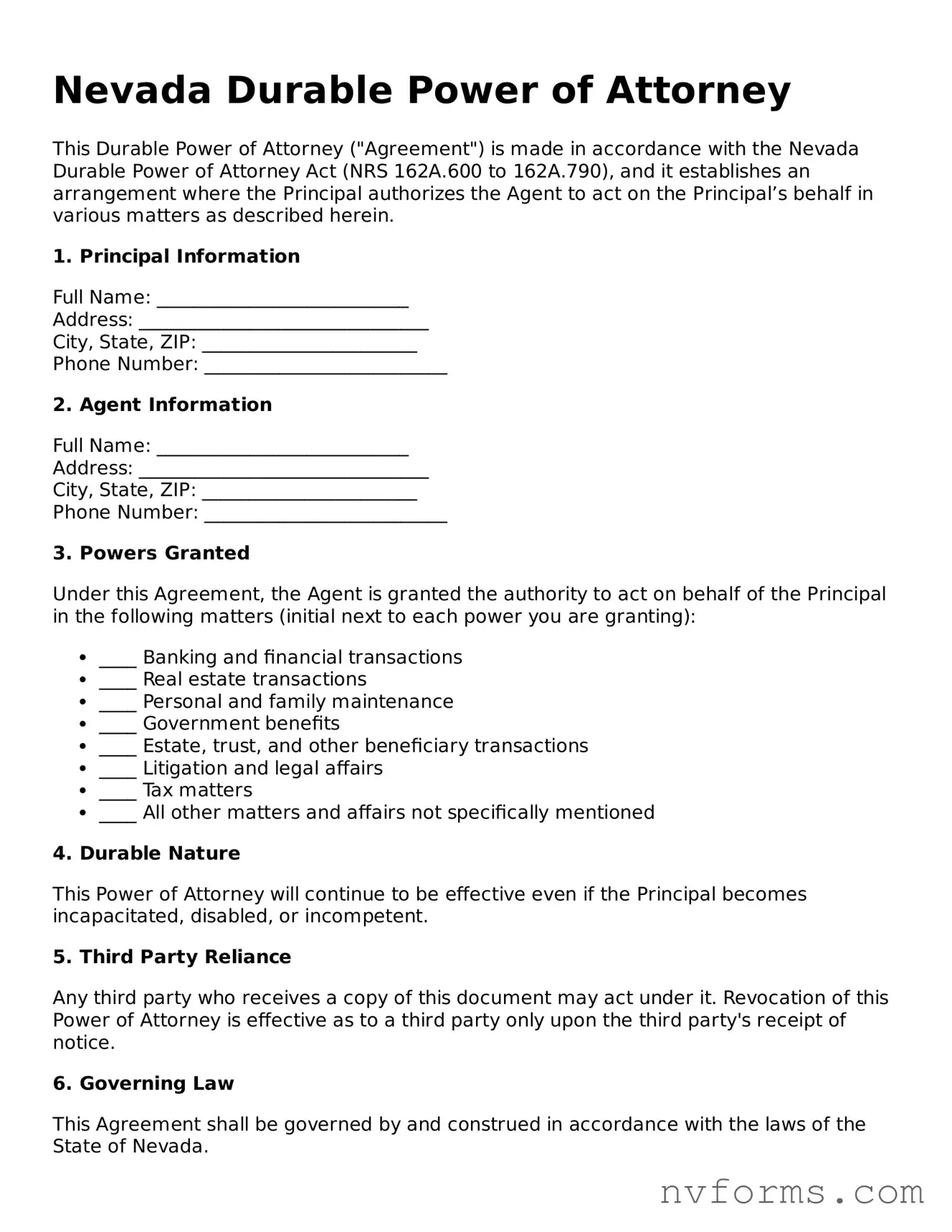

Free Durable Power of Attorney Form for Nevada

A Durable Power of Attorney form in Nevada is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to manage their affairs. This arrangement remains in effect even if the principal becomes incapacitated. It's a crucial tool for estate planning, ensuring that an individual's financial matters are handled according to their wishes should they be unable to manage them personally.

Launch Editor

Free Durable Power of Attorney Form for Nevada

Launch Editor

Launch Editor

or

⇩ Durable Power of Attorney File

Don’t stop now — finish the form

Finish Durable Power of Attorney online using an easy step-by-step flow.