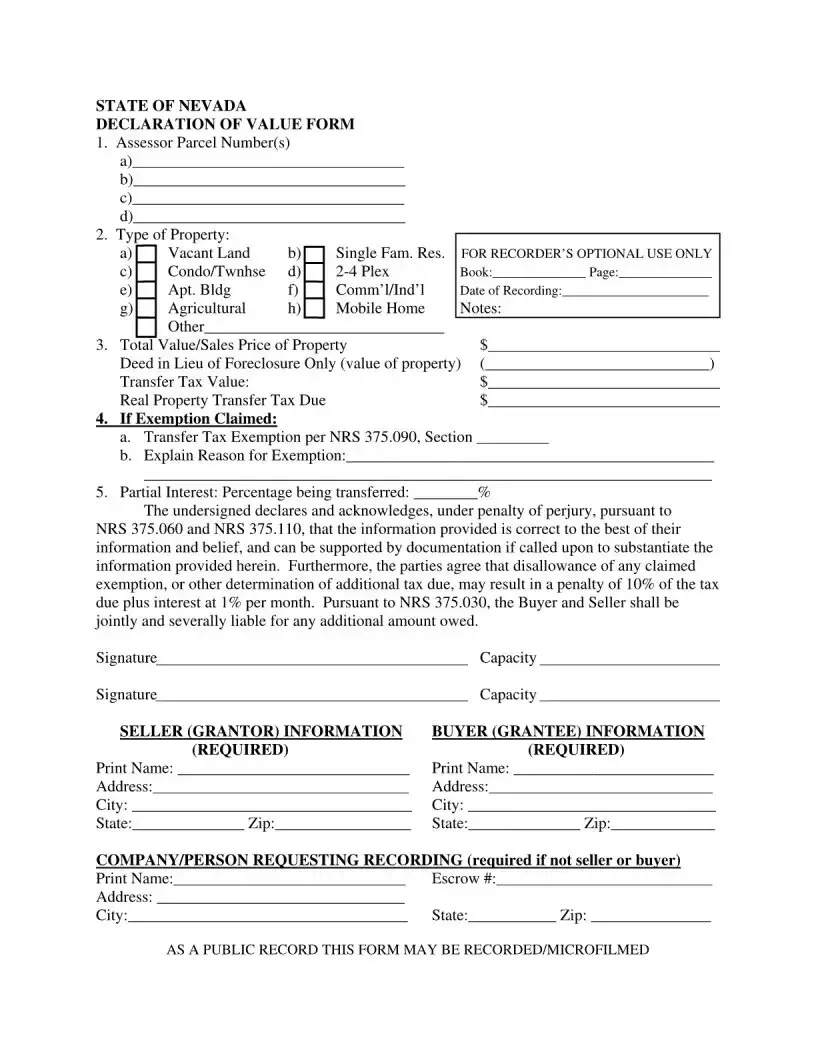

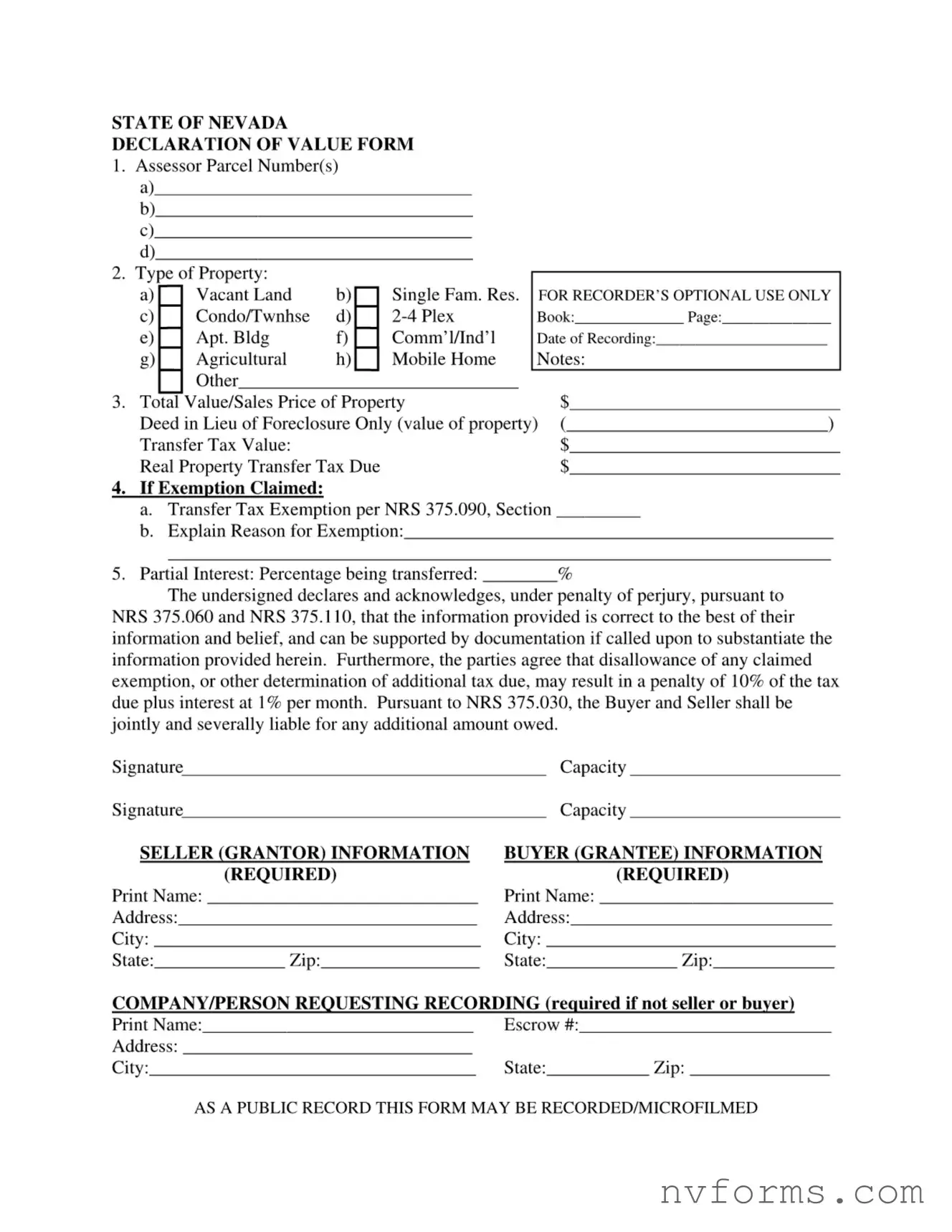

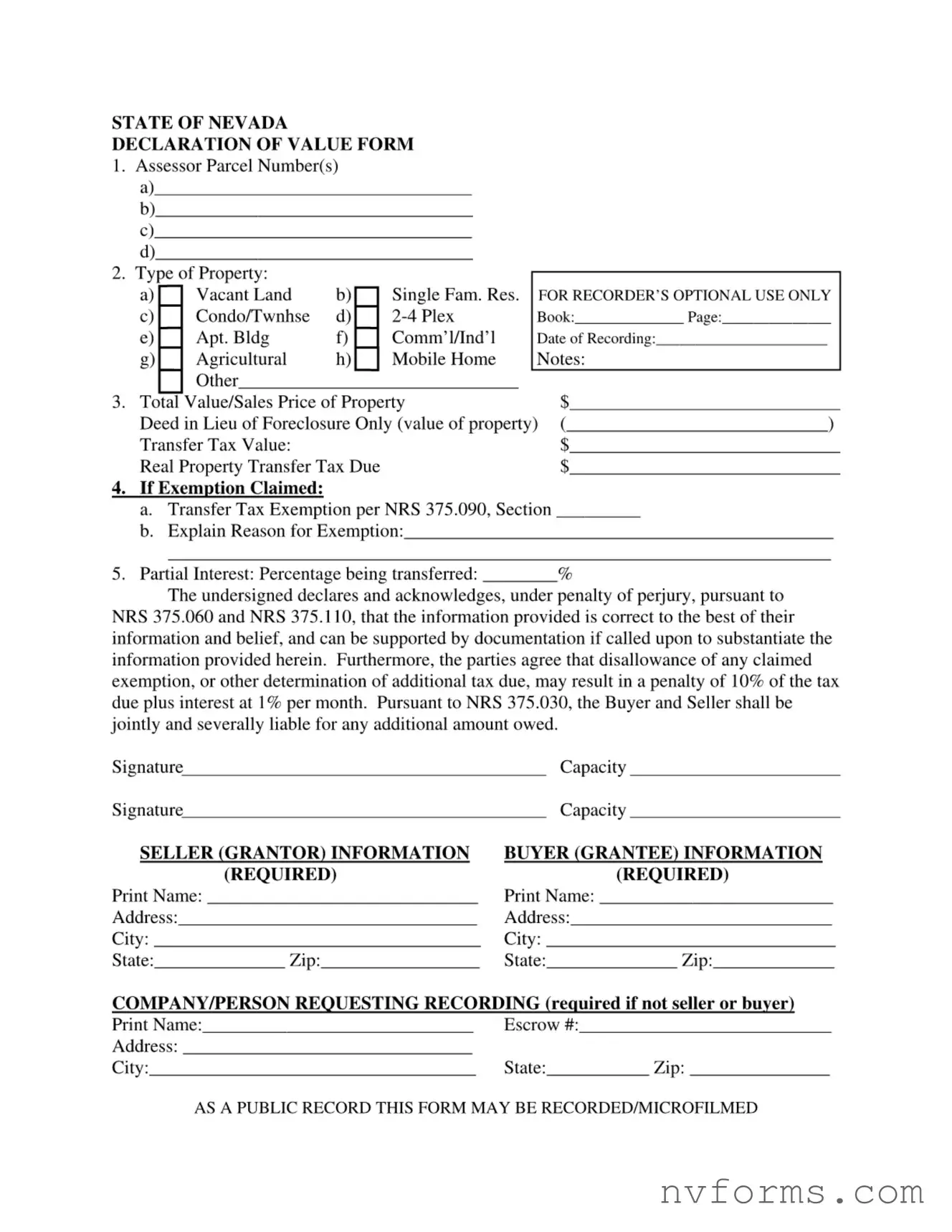

Fill Out a Valid Nevada Declaration Of Value Template

The Nevada Declaration of Value form is a required document that records the sale price of a property during its transfer between parties. It serves as a crucial component for assessing real estate transfer taxes imposed by the state. This form provides transparency and ensures the correct calculation of taxes based on the reported value of the property transaction.

Launch Editor

Fill Out a Valid Nevada Declaration Of Value Template

Launch Editor

Launch Editor

or

⇩ Nevada Declaration Of Value File

Don’t stop now — finish the form

Finish Nevada Declaration Of Value online using an easy step-by-step flow.