Fill Out a Valid Nevada Employment Security Division Template

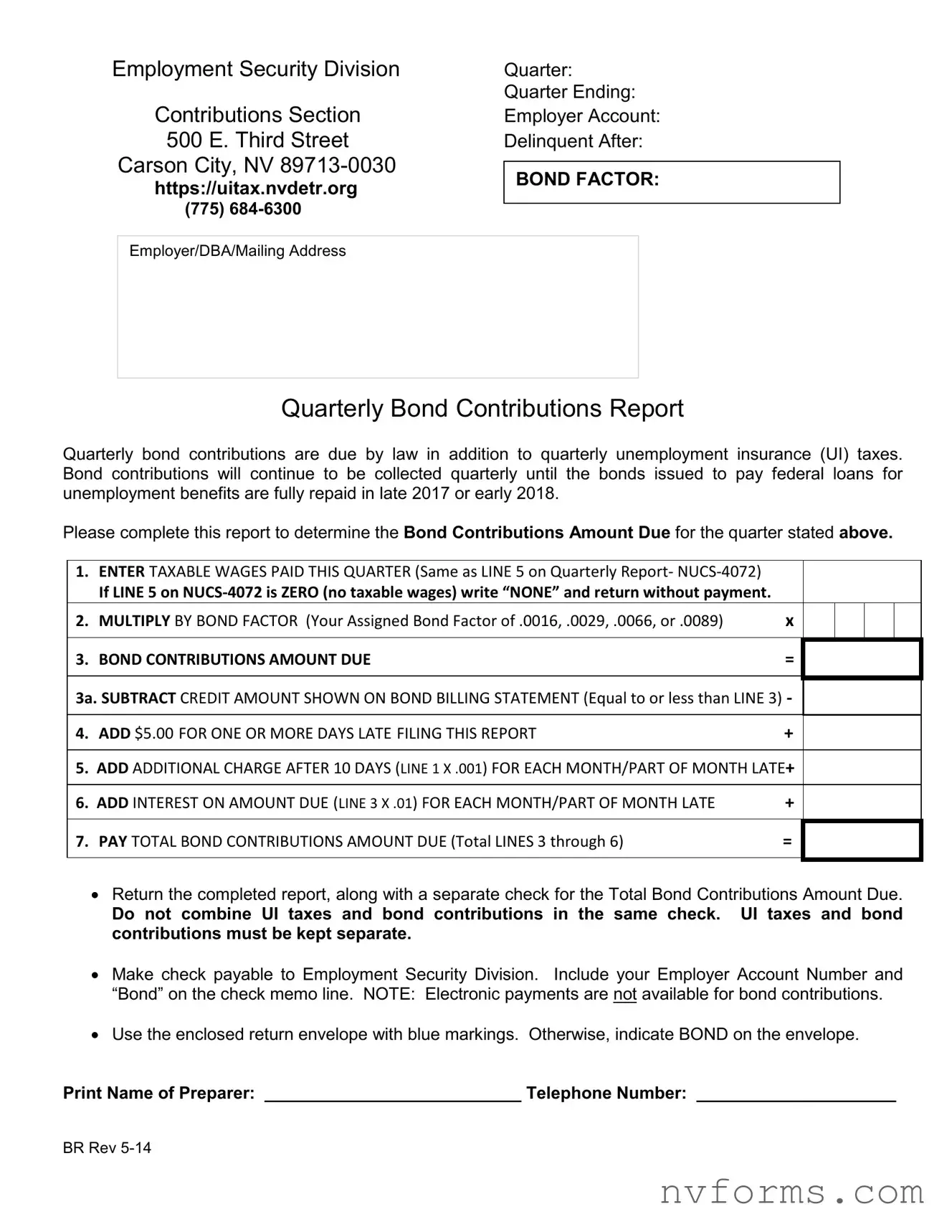

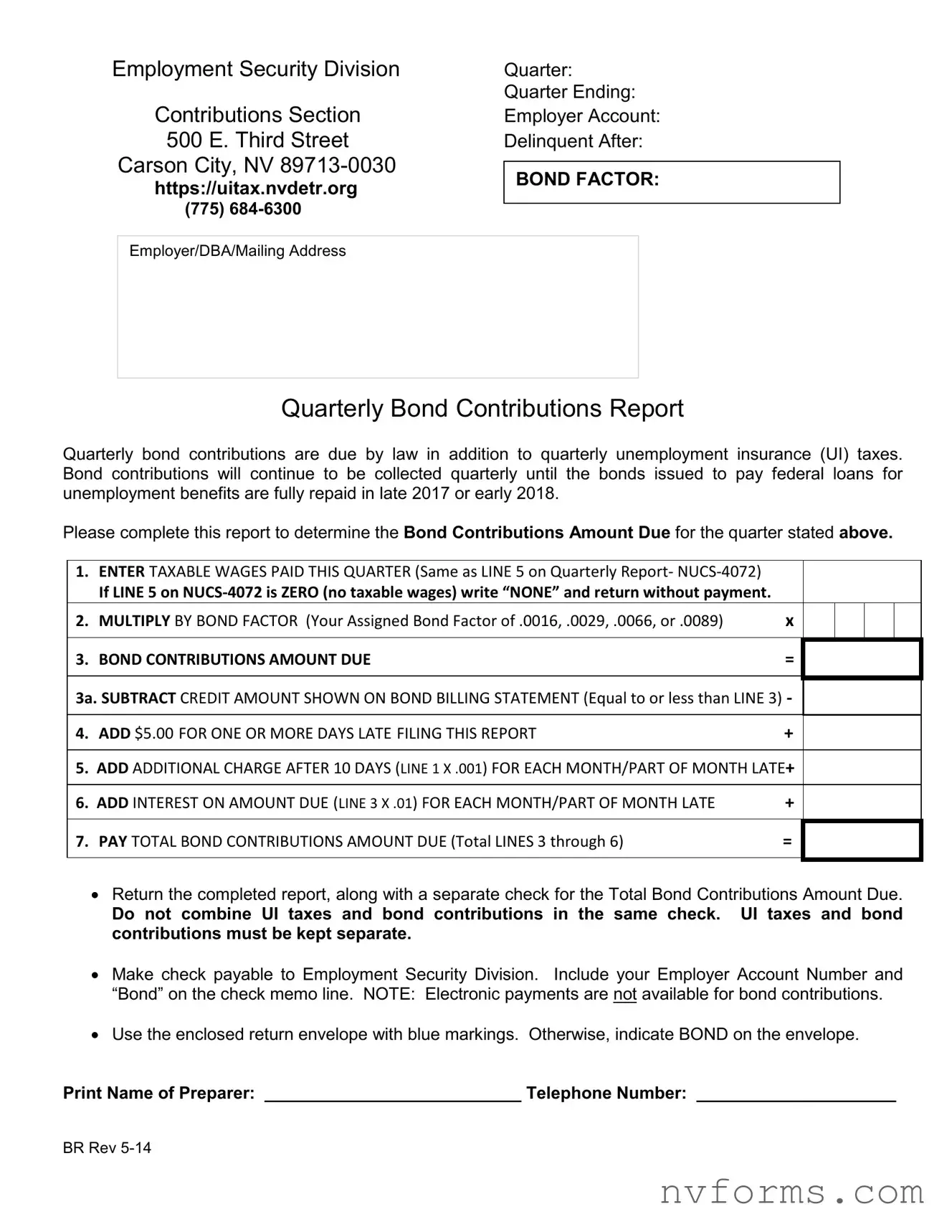

The Nevada Employment Security Division form is a vital document for state employers, focused on the calculation and reporting of quarterly bond contributions along with unemployment insurance (UI) taxes. These contributions are mandatory until the bonds, which finance federal loans for unemployment benefits, are fully repaid—anticipated around late 2017 or early 2018. Completing this form accurately is essential for ensuring that bond contributions are made correctly for the specified quarter.

Launch Editor

Fill Out a Valid Nevada Employment Security Division Template

Launch Editor

Launch Editor

or

⇩ Nevada Employment Security Division File

Don’t stop now — finish the form

Finish Nevada Employment Security Division online using an easy step-by-step flow.