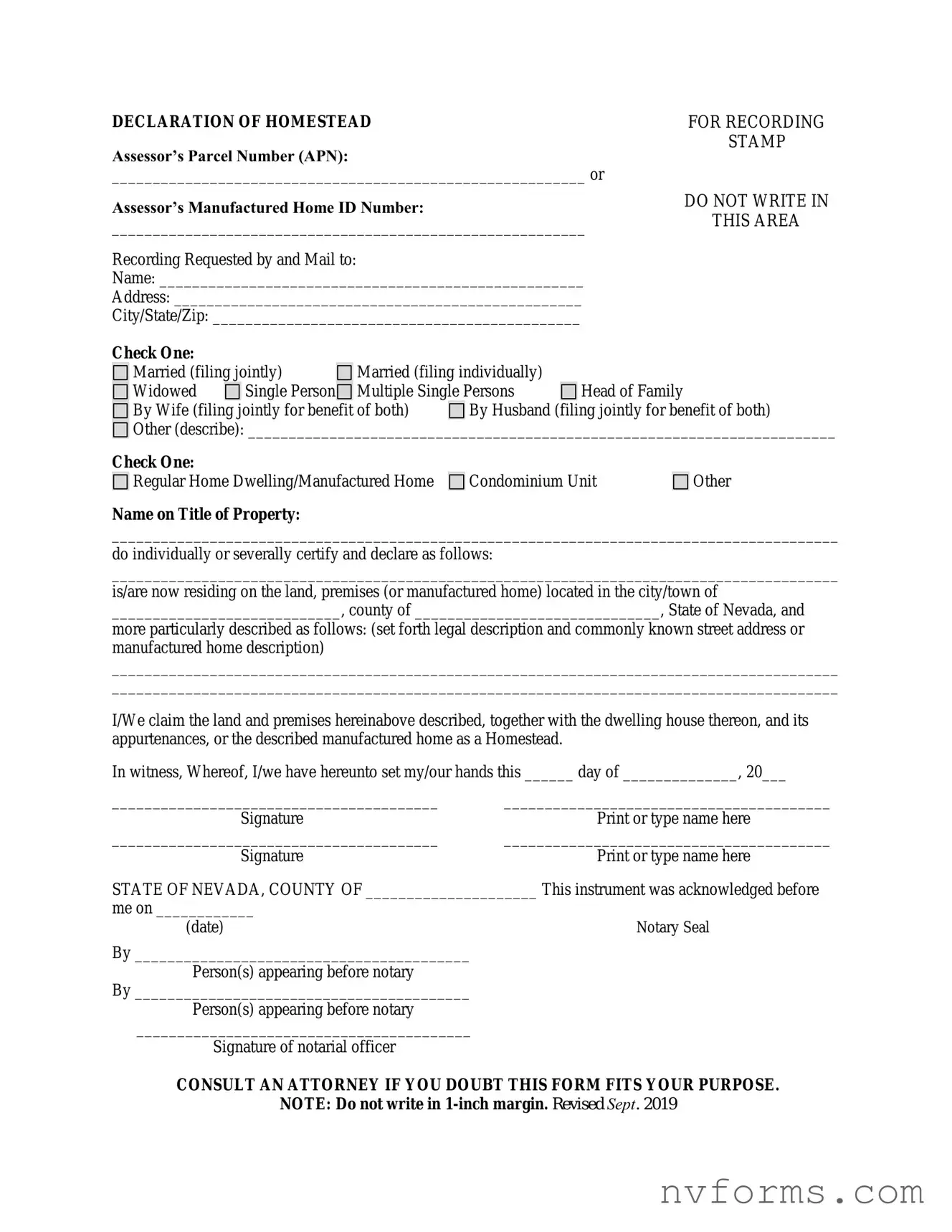

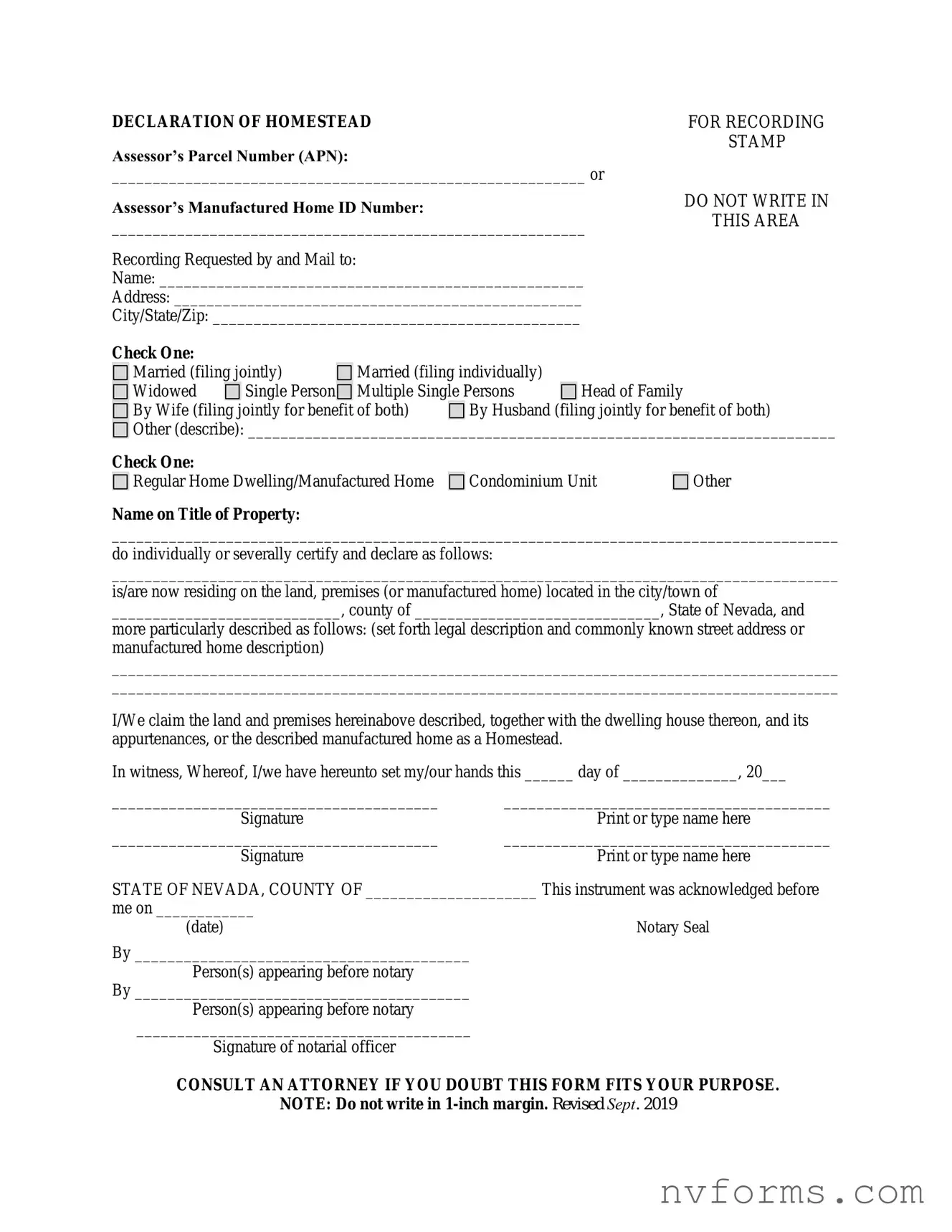

DECLARATION OF HOMESTEAD

Assessor’s Parcel Number (APN):

__________________________________________________________ or

Assessor’s Manufactured Home ID Number:

__________________________________________________________

Recording Requested by and Mail to:

Name: ____________________________________________________

Address: __________________________________________________

City/State/Zip: _____________________________________________

FOR RECORDING

STAMP

DO NOT WRITE IN

THIS AREA

Check One: |

|

|

|

|

|

|

|

|

|

Married (filing jointly) |

|

Married (filing individually) |

|

|

|

Widowed |

|

Single Person |

|

Multiple Single Persons |

|

Head of Family |

|

By Wife (filing jointly for benefit of both) |

|

By Husband (filing jointly for benefit of both) |

Other (describe): ________________________________________________________________________

Other (describe): ________________________________________________________________________

Check One: |

|

|

Regular Home Dwelling/Manufactured Home |

Condominium Unit |

Other |

Name on Title of Property:

_________________________________________________________________________________________

do individually or severally certify and declare as follows:

_________________________________________________________________________________________

is/are now residing on the land, premises (or manufactured home) located in the city/town of

____________________________, county of ______________________________, State of Nevada, and

more particularly described as follows: (set forth legal description and commonly known street address or manufactured home description)

_________________________________________________________________________________________

_________________________________________________________________________________________

I/We claim the land and premises hereinabove described, together with the dwelling house thereon, and its appurtenances, or the described manufactured home as a Homestead.

In witness, Whereof, I/we have hereunto set my/our hands this ______ day of ______________, 20___

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

________________________________________ |

________________________________________ |

Signature |

Print or type name here |

STATE OF NEVADA, COUNTY OF _____________________ This instrument was acknowledged before

me on ____________

(date)

By _________________________________________

Person(s) appearing before notary

By _________________________________________

Person(s) appearing before notary

_________________________________________

Signature of notarial officer

CONSULT AN ATTORNEY IF YOU DOUBT THIS FORM FITS YOUR PURPOSE.

NOTE: Do not write in 1-inch margin. Revised Sept. 2019

Other (describe): ________________________________________________________________________

Other (describe): ________________________________________________________________________