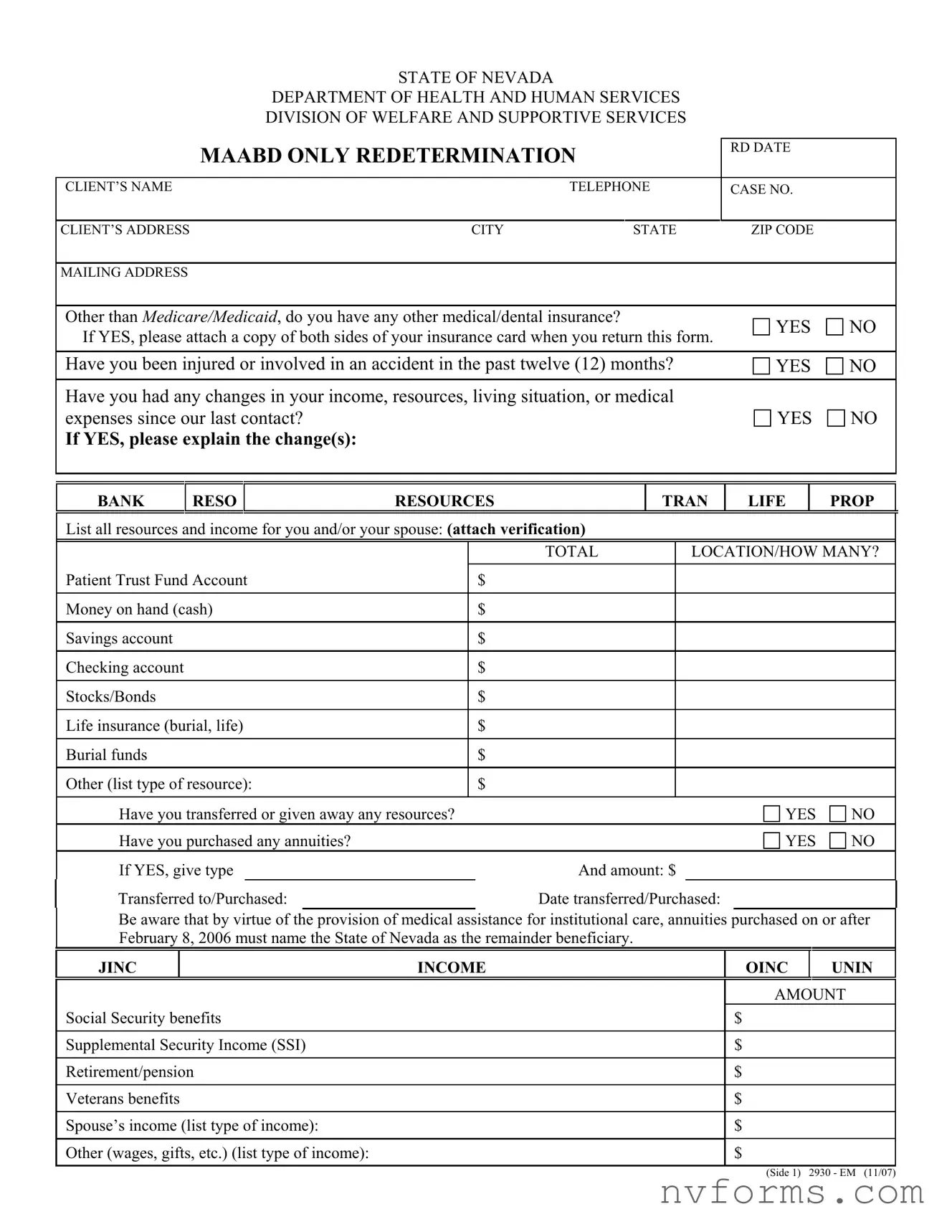

Welcome to the FAQ section on the Nevada Medicaid Redetermination form. This guide is designed to address common questions and concerns, helping ensure individuals have the necessary information to complete and submit their forms accurately. The goal is to assist in maintaining Medicaid benefits without interruption.

- What is the Nevada Medicaid Redetermination form?

The Nevada Medicaid Redetermination form is a document used by the State of Nevada Department of Health and Human Services, Division of Welfare and Supportive Services, to reassess eligibility for Medicaid benefits. It is crucial for ensuring that individuals who require medical assistance continue to receive the support they need based on current information regarding their income, resources, living conditions, and medical expenses.

- Why is it important to complete the Redetermination form?

Completing and returning the Redetermination form is vital because it directly affects your eligibility for Medicaid benefits. Failure to submit the form could result in the termination of benefits. It ensures that the information on file is up to date and that you or your spouse receive the appropriate level of assistance.

- What should I do if I have other medical or dental insurance?

If you have other medical or dental insurance, it is important to indicate this on the Redetermination form and attach a copy of both sides of your insurance card. This allows for accurate coordination of benefits and ensures that Medicaid can work effectively with your other insurance providers.

- How do I report changes in my income, resources, or living situation?

Any changes in your income, resources, living situation, or medical expenses should be clearly explained in the designated section of the form. It is also necessary to attach verification for all listed resources and income for you and/or your spouse. Accurate reporting helps determine the correct level of benefits you are eligible for.

- What information is required regarding annuities?

If you have purchased annuities, you must disclose the type and amount on the form. Since February 8, 2006, annuities purchased for medical assistance for institutional care must name the State of Nevada as the remainder beneficiary. This requirement is part of the Medicaid eligibility criteria and helps protect the state's interest.

- What should I do if I've had changes not listed on the form?

If you've had changes not specifically listed on the form, describe them in the provided space. This could include additional income, resources not mentioned, or any other significant changes affecting your eligibility. Providing complete information ensures accurate assessment of your situation.

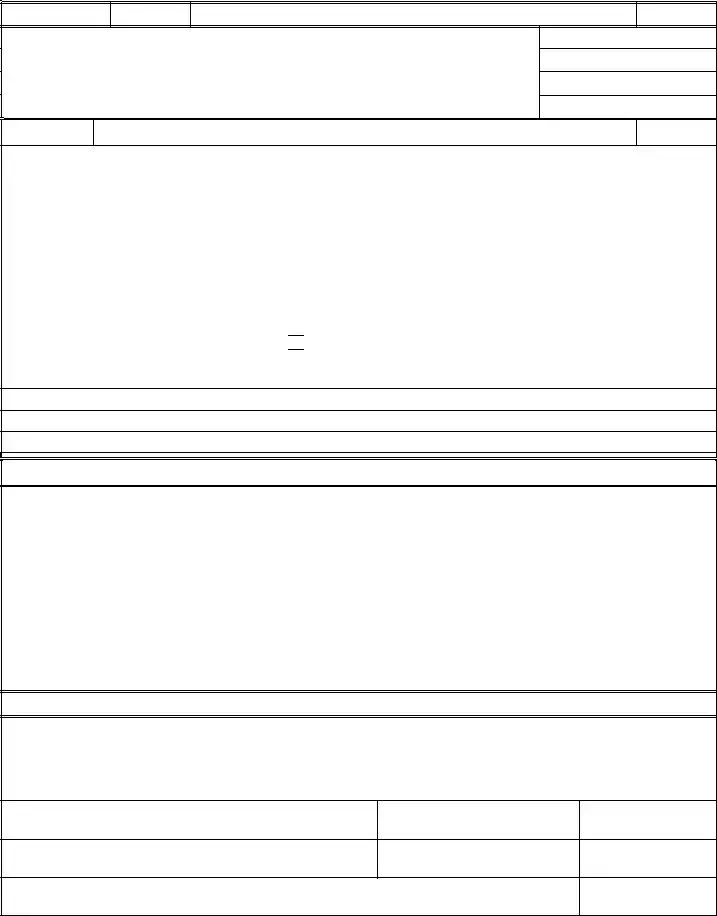

- How do I name or change an authorized representative (A/R)?

To name or change an authorized representative, check the appropriate box on the form. Your case manager will send you a document to record your request, which must be completed and returned. An authorized representative can act on your behalf regarding your Medicaid case, providing an extra layer of support.

- What are my rights and responsibilities?

Your rights and responsibilities were detailed at the time of your application and continue to apply throughout your participation in the Medicaid program. You may contact your local office to receive a copy of these provisions, which include compliance with program requirements and the importance of providing accurate and truthful information.

- Why are Social Security Numbers (SSNs) required?

SSNs are required for all individuals receiving or seeking to receive assistance to verify family income and resources. They are used in computer matching with other agencies, investigations, and to prevent duplication of benefits. Providing your SSN is essential for maintaining transparency and eligibility for Medicaid benefits.

This FAQ aims to clarify the purpose and importance of the Nevada Medicaid Redetermination form, highlighting key components and requirements. Accurately completing and returning this form is crucial for continuing to receive Medicaid benefits and ensuring your health and well-being.

. Your case manager will send you a document to record your request. It must be completed and returned before your representative will be acknowledged on your case.

. Your case manager will send you a document to record your request. It must be completed and returned before your representative will be acknowledged on your case.