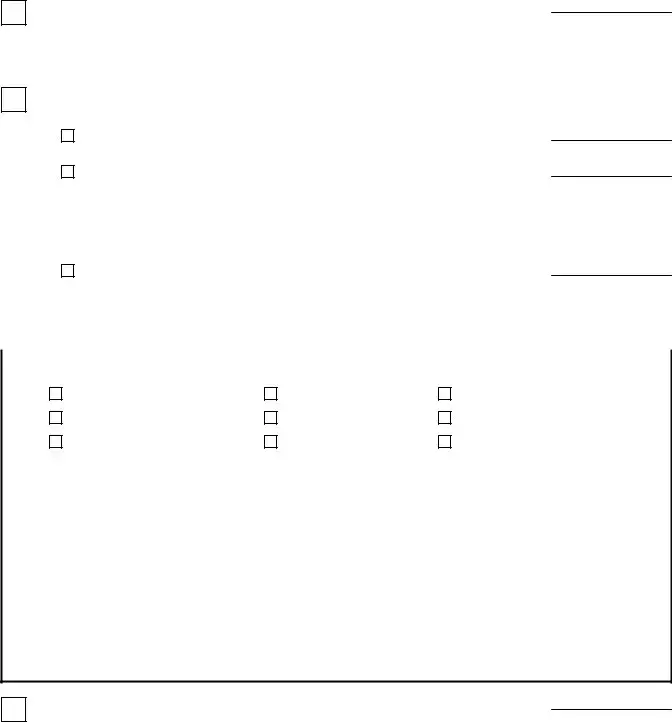

E M P L O Y E R ' S R E P O R T O F C H A N G E S

E m p l o y e r A c c o u n t N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ T e l e p h o n e N u m b e r : _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Business Discontinued (no new ownership) ..........................................................

M o n t h / D a y / Y e a r

( P l e a s e n o t i f y t h e D i v i s i o n i f , o r w h e n , b u s i n e s s r e s u m e s . )

E x a c t D a t e o f L a s t P a y r o l l _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

M o n t h / D a y / Y e a r

C h a n g e i n B u s i n e s s O w n e r s h i p - C o m p l e t e N E W O W N E R ( S ) s e c t i o n b e l o w .

Sale of Entire Business .............................................................................

M o n t h / D a y / Y e a r

Partial Sale (not out of business) ..............................................................

M o n t h / D a y / Y e a r

D e s c r i b e P a r t S o l d _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

Change in Legal Ownership .....................................................................

( s u c h a s a d d i n g o r d r o p p i n g a p a r t n e r , i n c o r p o r a t i n g , e t c . )

M o n t h / D a y / Y e a r

N E W O W N E R ( S ) |

N e w F e d e r a l I d e n t i f i c a t i o n N u m b e r ( i f a p p l i c a b l e ) : |

|

|

|

|

|

C h e c k T y p e o f O r g a n i z a t i o n: |

|

|

S C o r p o r a t i o n |

S o l e P r o p r i e t o r |

L i m i t e d L i a b i l i t y P a r t n e r s h i p |

P u b l i c l y T r a d e d C o r p o r a t i o n |

A s s o c i a t i o n |

L i m i t e d L i a b i l i t y C o m p a n y |

P r i v a t e l y H e l d C o r p o r a t i o n |

P a r t n e r s h i p |

O t h e r |

N a m e a n d a d d r e s s o f n e w o w n e r ( s ) , p a r t n e r ( s ) , c o r p o r a t e o f f i c e r ( s ) , m e m b e r ( s ) , e t c . _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

R e m a r k s _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

New Business Units Added to Present Ownership .................................................

M o n t h / D a y / Y e a r

T r a d e N a m e _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

L o c a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N a t u r e o f O p e r a t i o n _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

P r e v i o u s O w n e r ( s ) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

N U C S - 4 0 7 2 ( R e v . 9 - 0 2 )

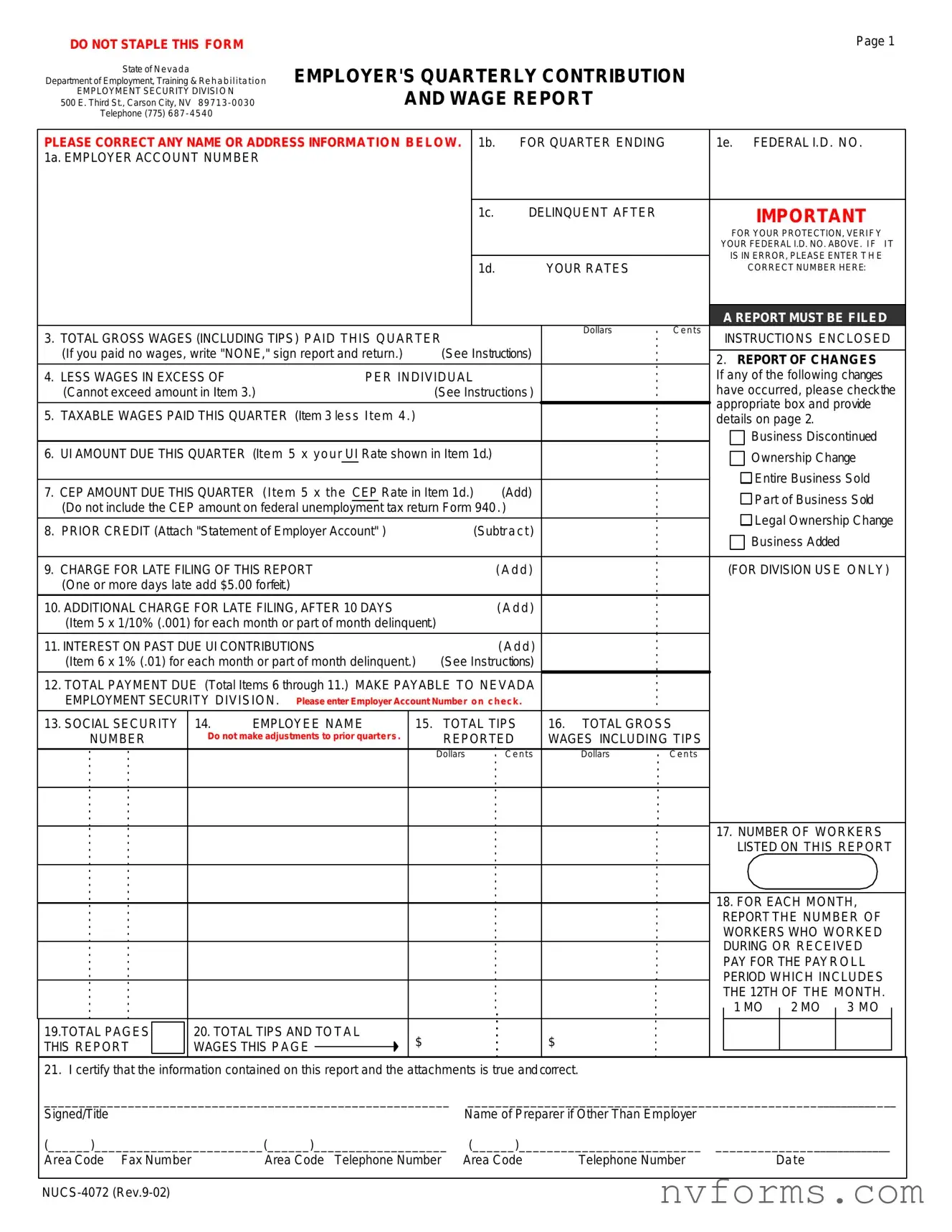

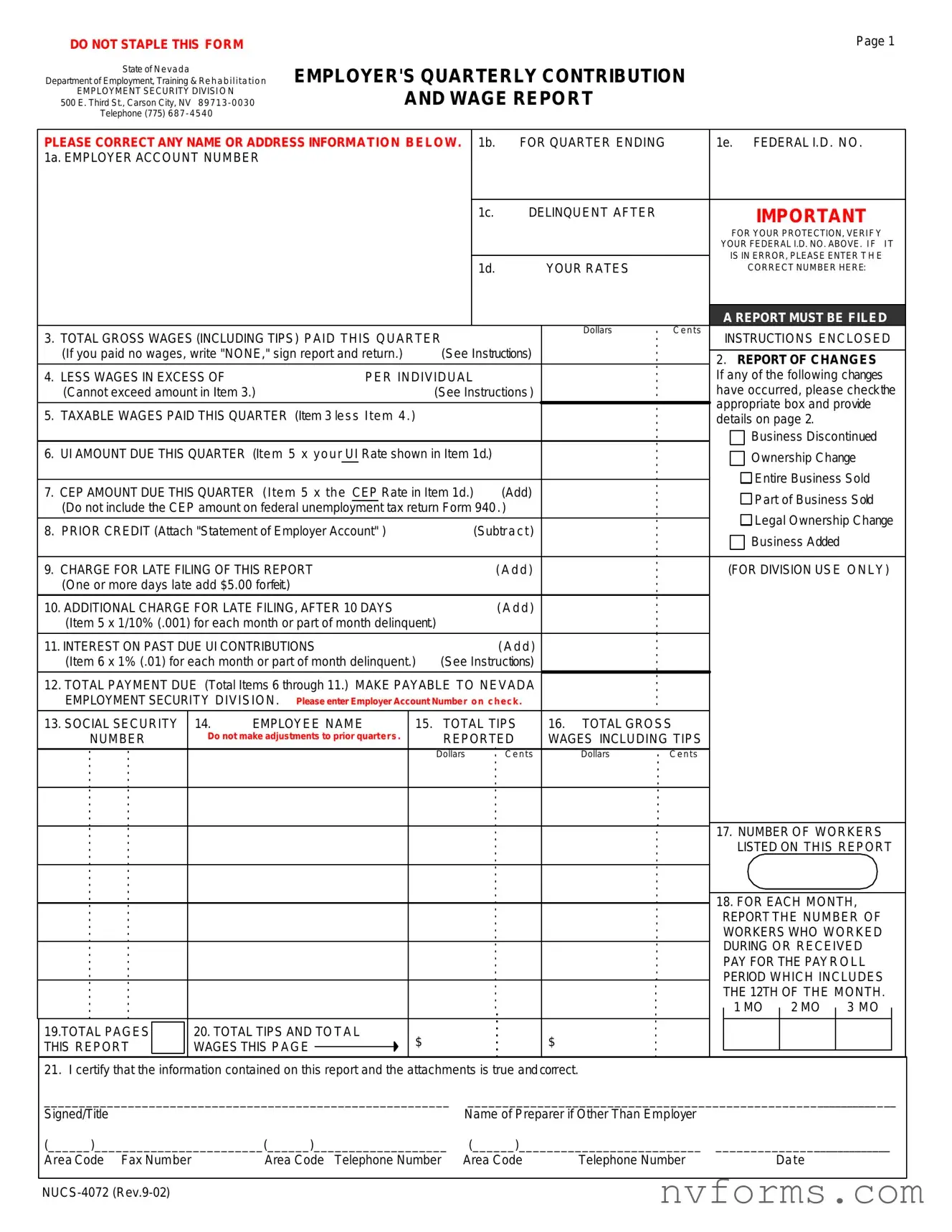

STATE OF NEVADA

DEPARTMENT OF EMPLOYMENT, TRAINING AND REHABILITATION

EMPLOYMENT SECURITY DIVISION

500 E. Third Street

Carson City, Nevada 89713-0030

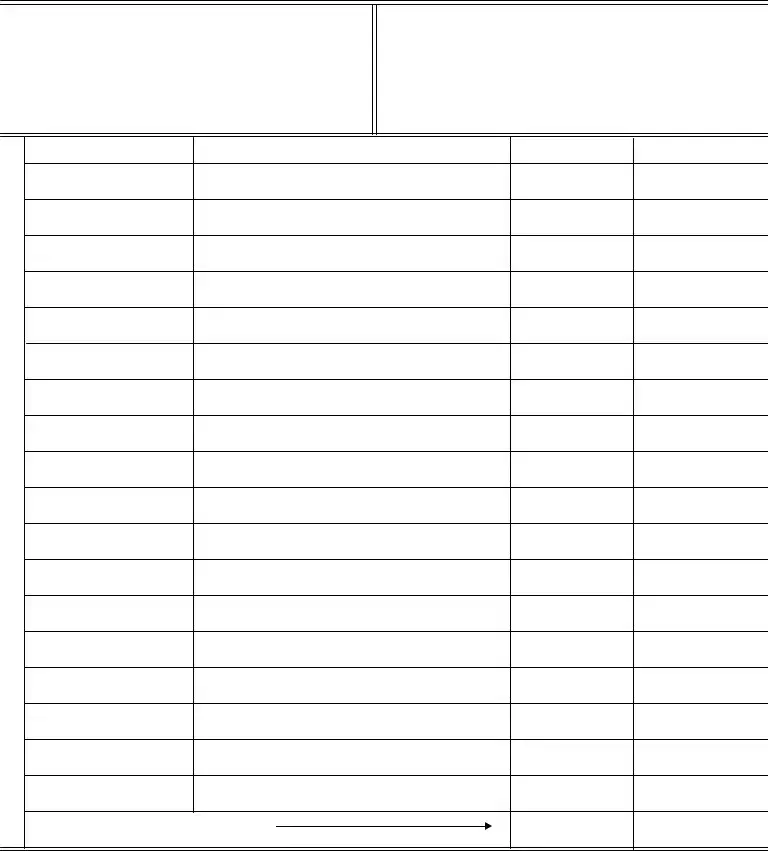

CONTINUATION SHEET

EMPLOYER'S QUARTERLY LIST OF WAGES PAID

EMPLOYER ACCOUNT NUMBER

NAME

ADDRESS

FOR QUARTER ENDING |

PAGE NUMBER |

|

|

|

|

ENCLOSE THIS FORM WITH THE "EMPLOYER'S QUARTERLY CONTRIBUTION AND WAGE REPORT" (FORM NUCS-4072)

Report Not Complete if Social Security Numbers Are Missing

TOTAL TIPS REPORTED

THIS QUARTER

TOTAL WAGES (INCLUDING REPORTED TIPS) THIS QUARTER

TOTAL TIPS AND TOTAL WAGES THIS PAGE