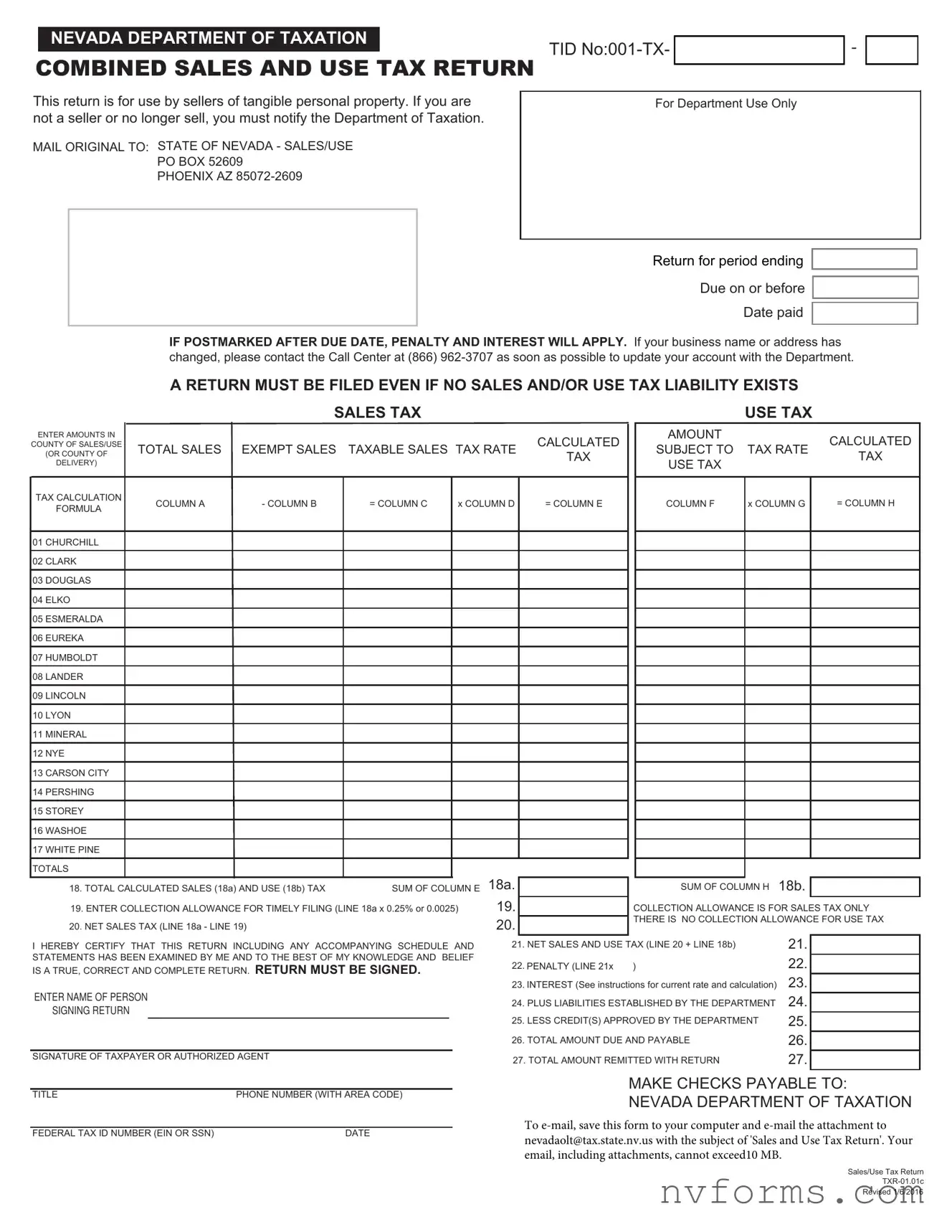

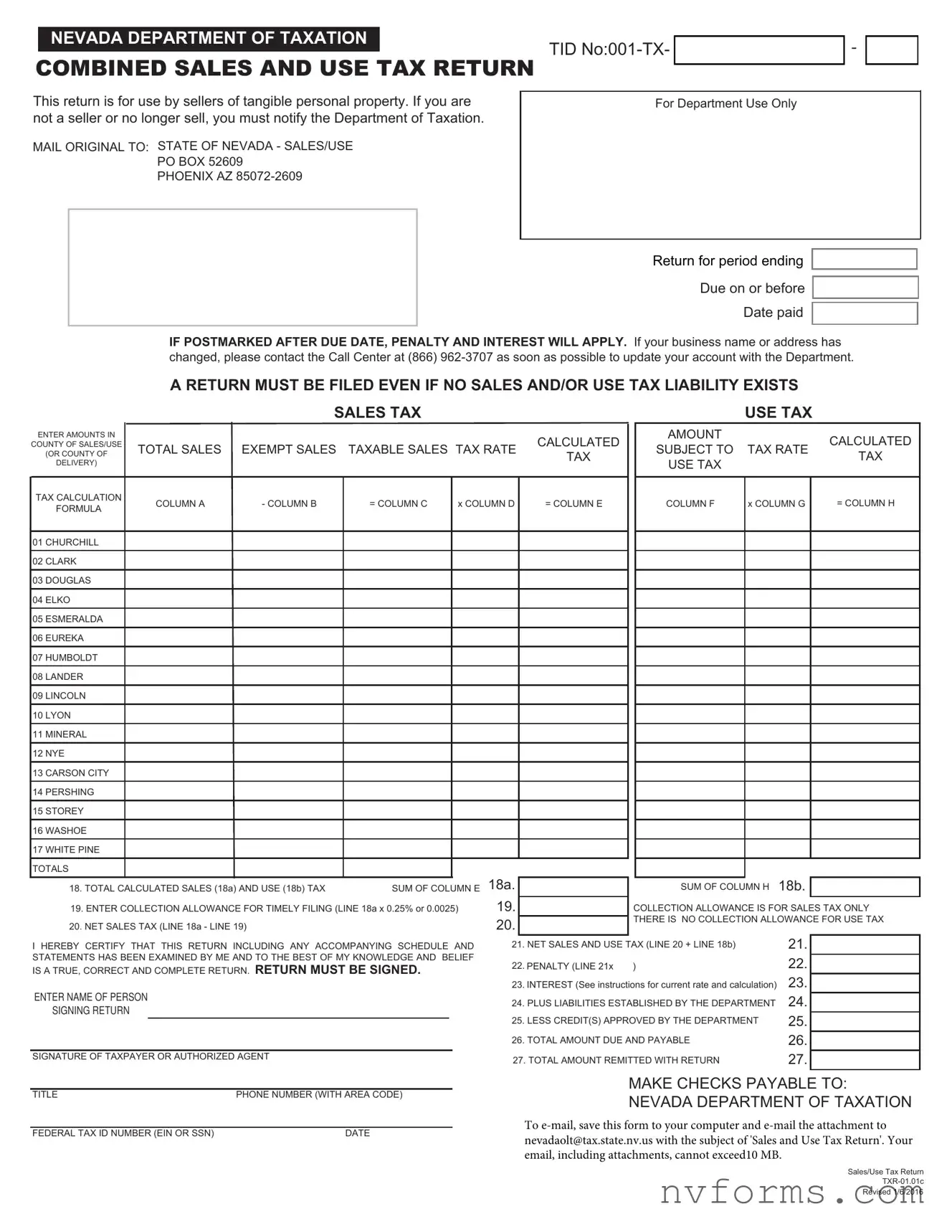

NEVADA DEPARTMENT OF TAXATION

TID No:001-TX-

COMBINED SALES AND USE TAX RETURN

This return is for use by sellers of tangible personal property. If you are not a seller or no longer sell, you must notify the Department of Taxation.

MAIL ORIGINAL TO: STATE OF NEVADA - SALES/USE

PO BOX 52609

PHOENIX AZ 85072-2609

For Department Use Only

Return for period ending

Due on or before

Date paid

IF POSTMARKED AFTER DUE DATE, PENALTY AND INTEREST WILL APPLY. If your business name or address has changed, please contact the Call Center at (866) 962-3707 as soon as possible to update your account with the Department.

|

|

|

A RETURN MUST BE FILED EVEN IF NO SALES AND/OR USE TAX LIABILITY EXISTS |

|

|

|

|

|

SALES TAX |

|

|

|

|

|

|

|

USE TAX |

|

ENTER AMOUNTS IN |

|

|

|

|

|

|

|

|

|

CALCULATED |

|

|

AMOUNT |

|

|

|

CALCULATED |

COUNTY OF SALES/USE |

|

TOTAL SALES |

EXEMPT SALES |

TAXABLE SALES TAX RATE |

|

|

SUBJECT TO |

TAX RATE |

(OR COUNTY OF |

|

TAX |

|

|

TAX |

DELIVERY) |

|

|

|

|

|

|

|

|

|

|

|

USE TAX |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TAX CALCULATION |

|

|

COLUMN A |

- COLUMN B |

= COLUMN C |

x COLUMN D |

|

= COLUMN E |

|

|

COLUMN F |

x COLUMN G |

|

= COLUMN H |

FORMULA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

01 CHURCHILL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

02 CLARK |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

03 DOUGLAS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

04 ELKO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

05 ESMERALDA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

06 EUREKA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

07 HUMBOLDT |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

08 LANDER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

09 LINCOLN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 LYON |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11 MINERAL |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

12 NYE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13 CARSON CITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14 PERSHING |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

15 STOREY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

16 WASHOE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

17 WHITE PINE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTALS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18a. |

|

|

|

|

|

|

18b. |

|

|

18. TOTAL CALCULATED SALES (18a) AND USE (18b) TAX |

SUM OF COLUMN E |

|

|

|

|

SUM OF COLUMN H |

|

|

|

|

|

|

|

|

19. |

|

|

|

|

|

|

19. ENTER COLLECTION ALLOWANCE FOR TIMELY FILING (LINE 18a x 0.25% or 0.0025) |

|

|

|

COLLECTION ALLOWANCE IS FOR SALES TAX ONLY |

20. NET SALES TAX (LINE 18a - LINE 19) |

|

|

|

20. |

|

|

|

THERE IS NO COLLECTION ALLOWANCE FOR USE TAX |

|

|

|

|

|

|

|

|

|

|

|

|

I HEREBY CERTIFY THAT THIS RETURN INCLUDING ANY ACCOMPANYING SCHEDULE AND |

21. NET SALES AND USE TAX (LINE 20 + LINE 18b) |

|

21. |

|

|

STATEMENTS HAS BEEN EXAMINED BY ME AND TO THE BEST OF MY KNOWLEDGE AND BELIEF |

22. |

PENALTY (LINE 21x |

) |

|

|

22. |

|

|

IS A TRUE, CORRECT AND COMPLETE RETURN. RETURN MUST BE SIGNED. |

|

|

|

|

|

|

23. INTEREST (See instructions for current rate and calculation) |

23. |

|

|

|

|

|

|

|

|

|

|

|

|

ENTER NAME OF PERSON |

|

|

|

|

24. PLUS LIABILITIES ESTABLISHED BY THE DEPARTMENT |

24. |

|

|

SIGNING RETURN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

25. LESS CREDIT(S) APPROVED BY THE DEPARTMENT |

25. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

26. TOTAL AMOUNT DUE AND PAYABLE |

|

26. |

|

|

SIGNATURE OF TAXPAYER OR AUTHORIZED AGENT |

|

|

|

27. TOTAL AMOUNT REMITTED WITH RETURN |

|

27. |

|

|

|

|

|

|

|

|

|

|

|

|

|

TITLE |

PHONE NUMBER (WITH AREA CODE) |

|

|

FEDERAL TAX ID NUMBER (EIN OR SSN) |

DATE |

MAKE CHECKS PAYABLE TO:

NEVADA DEPARTMENT OF TAXATION

To e-mail, save this form to your computer and e-mail the attachment to nevadaolt@tax.state.nv.us with the subject of 'Sales and Use Tax Return'. Your email, including attachments, cannot exceed10 MB.

Sales/Use Tax Return

TXR-01.01c

Revised 1/6/2016

COMBINED SALES AND USE TAX RETURN INSTRUCTIONS

This return is for use by sellers of tangible personal property registered with the Department

A RETURN MUST BE FILED EVEN IF NO TAX LIABILITY EXISTS

LINES 1 THROUGH 17

COLUMN A: TOTAL SALES - On the appropriate county line, enter the amount of all sales (excluding the sales tax collected) related to Nevada business including (a) cash sales; (b) conditional sales; (c) sales exempt from tax.

COLUMN B: EXEMPT SALES - Enter that portion of your sales not subject to tax, i.e., sales (a) for which you receive a resale certificate; (b) to Federal Government, State of Nevada, its agencies, cities or counties and school districts; (c) to religious or charitable organizations for which you have copies of exemption letters on file; (d) newspapers of general circulation published at least once a week; (e) animals, seeds, annual plants and fertilizer, the end product of which is food for human consumption; (f) motor vehicle or special fuels used in internal combustion or diesel engines; (g) wood, presto logs, pellets, petroleum, gas and any other matter used to produce domestic heat and sold for home or household use; (h) prescription medicines dispensed pursuant to a prescription by a licensed physician, dentist or chiropodist; (i) food products sold for home preparation and consumption; (j) out-of-state sales.

.

COLUMN C: TAXABLE SALES - Total Sales (Column A) - Exempt Sales (Column B) = Taxable Sales (Column C).

COLUMN E: CALCULATED TAX - Taxable Sales (Column C) × Tax Rate (Column D) = Calculated Tax (Column E).

COLUMN F: AMOUNT SUBJECT TO USE TAX - On the appropriate county line, enter (a) the purchase price of merchandise, equipment or other tangible personal property purchased without payment of Nevada tax (by use of your resale certificate, or any other reason) and that was stored, used or consumed by you rather than being resold. NOTE: If you have a contract exemption, give contract exemption number.

COLUMN H: CALCULATED TAX - Amount Subject to Use Tax (Column F) × Tax Rate (Column G) = Calculated Tax (Column H).

LINE 18A Enter the total of Column E.

LINE 18B Enter the total of Column H.

LINE 19 Take the Collection Allowance only if the return and taxes are postmarked on or before the due date as shown on the face of this return. If not postmarked by the due date, the Collection Allowance is not allowed. To calculate the Collection Allowance multiply Line 18a × 0.25% (or .0025). NOTE: Pursuant to NRS 372.370, the Collection Allowance is applicable to Sales Tax only.

LINE 20 Subtract Line 19 from Line 18a and enter the result.

LINE 21 Add Line 20 to Line 18b and enter the result.

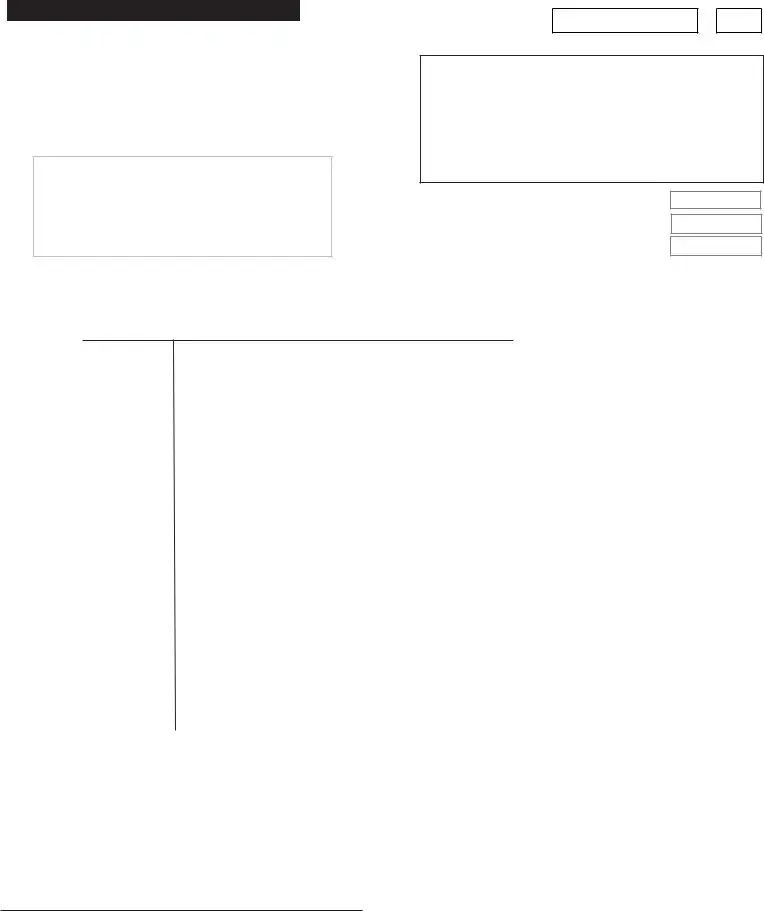

LINE 22 If this return is not submitted/postmarked and taxes are not paid on or before the due date as shown on the face of this return, the amount of penalty due is based on the number of days the payment is late per NAC 360.395 (see table below). The maximum penalty amount is 10%.

Number of days late |

Penalty Percentage |

Multiply by: |

|

|

|

1 - 10 |

2% |

0.02 |

|

|

|

11 - 15 |

4% |

0.04 |

|

|

|

16 - 20 |

6% |

0.06 |

|

|

|

21- 30 |

8% |

0.08 |

|

|

|

31 + |

10% |

0.10 |

|

|

|

Determine the number of days late the payment is, and multiply the net tax owed (Line 21) by the appropriate rate based on the table to the left. The result is the amount of penalty that should be entered. For example, if the taxes were due January 31, but not paid until February 15. The number of days late is 15 so the penalty is 4%. The penalty and interest amounts are automatically calculated for you if this form is completed on your computer.

LINE 23 To calculate interest, multiply Line 21 x 0.75% (or .0075) for each month payment is late.

LINE 24 Enter any amount due for prior reporting periods for which you have received a Department of Taxation billing notice.

LINE 25 Enter amount due to you for overpayment made in prior reporting periods for which you have received a Department of Taxation credit notice. Do not take the credit if you have applied for a refund. NOTE: Only credits established by the Department may be used.

LINE 26 Add Lines 21, 22, 23, 24 and then subtract Line 25 and enter the result.

LINE 27 Enter the total amount paid with this return.

Complete and detailed records of all sales, as well as income from all sources and expenditures for all purposes, must be kept so your return can be verified by a Department auditor.

YOU MUST COMPLETE THE SIGNATURE PORTION BY TYPING IN THE NAME OF THE PERSON SIGNING THE RETURN AND MAIL TO: Nevada Department of Taxation, PO Box 52609, Phoenix, AZ 85072-2609 or drop off at your

local office.

DO NOT SUBMIT A PHOTOCOPY OF A PRIOR PERIOD FORM, YOUR FILING WILL POST INCORRECTLY.

If you have questions concerning this return, please call our Department's Call Center at (866) 962-3707. ** For up-to-date information on tax issues, be sure to check our website -- ** http://tax.nv.gov/ -- every January, April, July and October for Tax Notes articles.

SALES/USE TAX RETURN INSTRUCTIONS

TXR-01.01c

Revised 01/04/2016