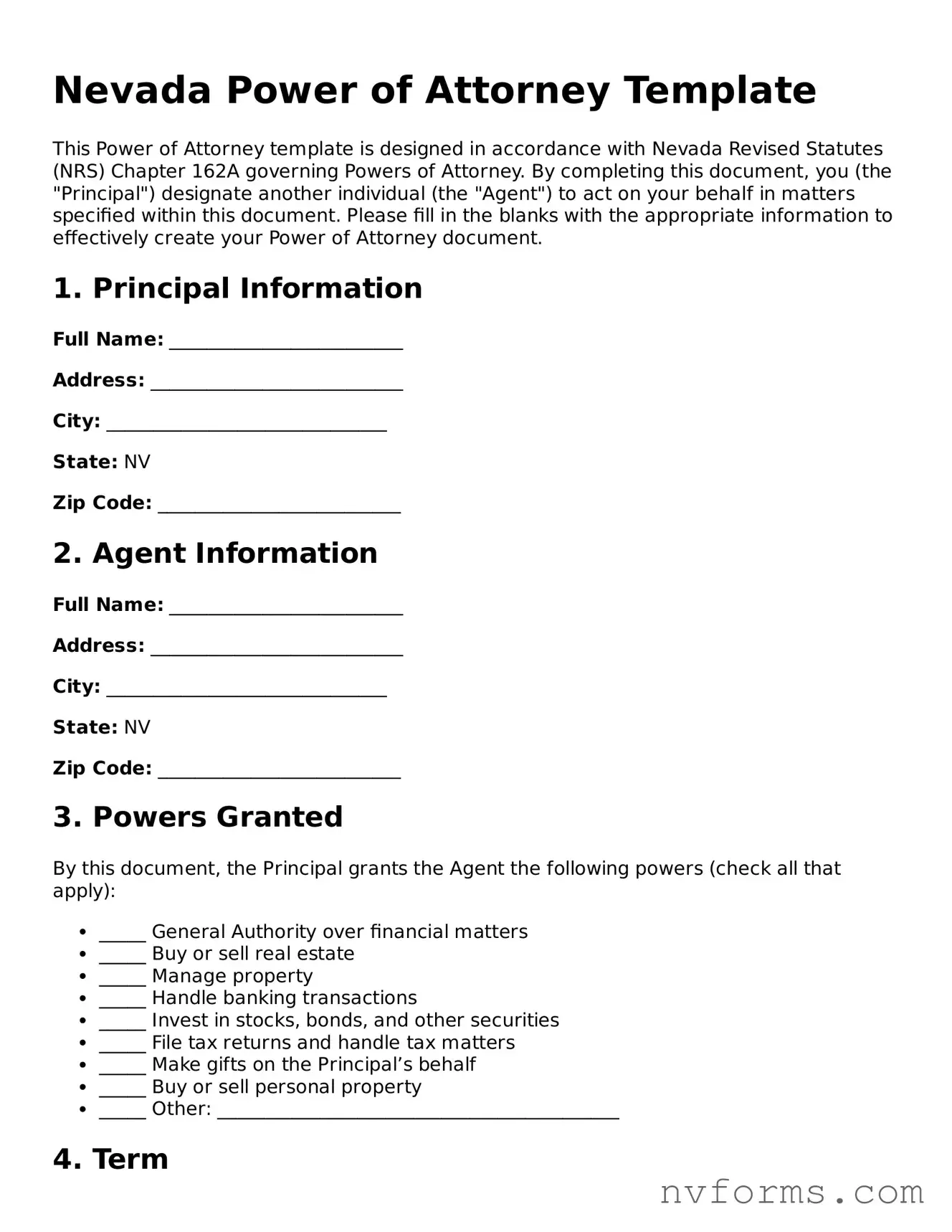

Free Power of Attorney Form for Nevada

The Nevada Power of Attorney form is a legal document that allows an individual, known as the principal, to grant another person the authority to make decisions on their behalf. This form is particularly useful in scenarios where the principal cannot be present to make those decisions themselves, due to various reasons. It serves as an essential tool for managing one’s affairs through the help of a trusted representative.

Launch Editor

Free Power of Attorney Form for Nevada

Launch Editor

Launch Editor

or

⇩ Power of Attorney File

Don’t stop now — finish the form

Finish Power of Attorney online using an easy step-by-step flow.