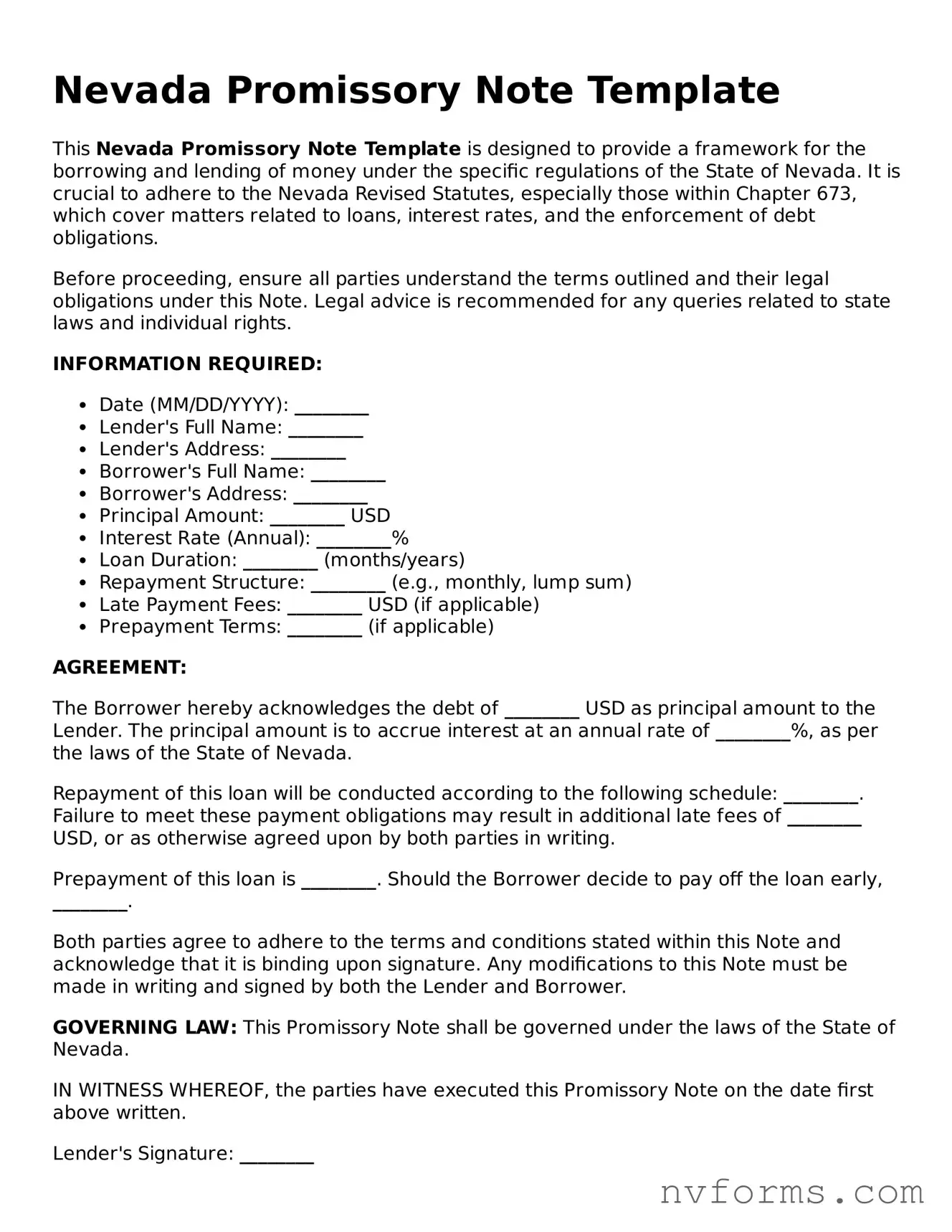

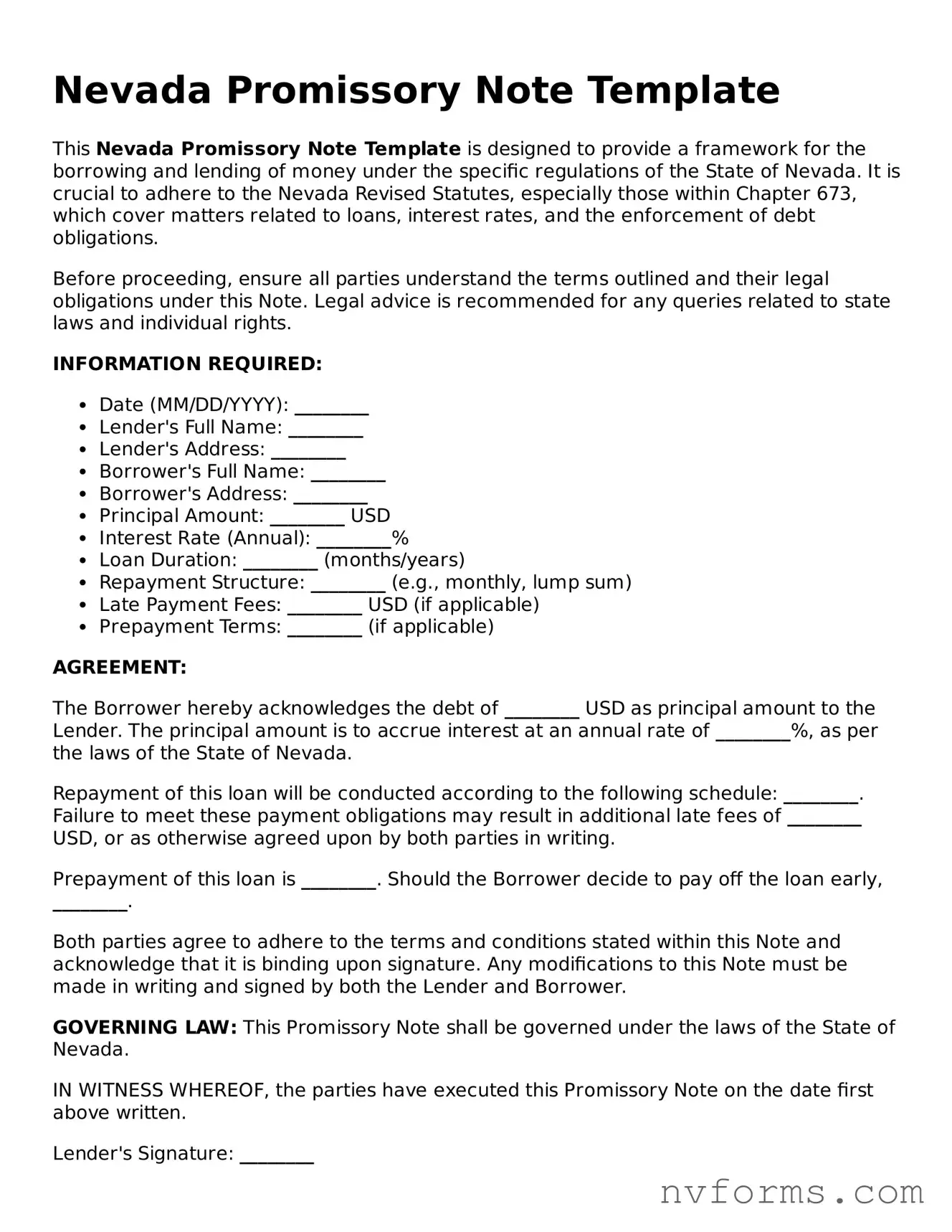

Free Promissory Note Form for Nevada

A Nevada Promissory Note form is a legal document that outlines a borrowing agreement between two parties, detailing the borrower's promise to pay back a specified sum of money to the lender. This form is governed by Nevada's laws and regulations, ensuring the legality of the financial transaction. It includes critical details such as the amount borrowed, interest rate, repayment schedule, and any relevant legal actions in case of non-payment.

Launch Editor

Free Promissory Note Form for Nevada

Launch Editor

Launch Editor

or

⇩ Promissory Note File

Don’t stop now — finish the form

Finish Promissory Note online using an easy step-by-step flow.