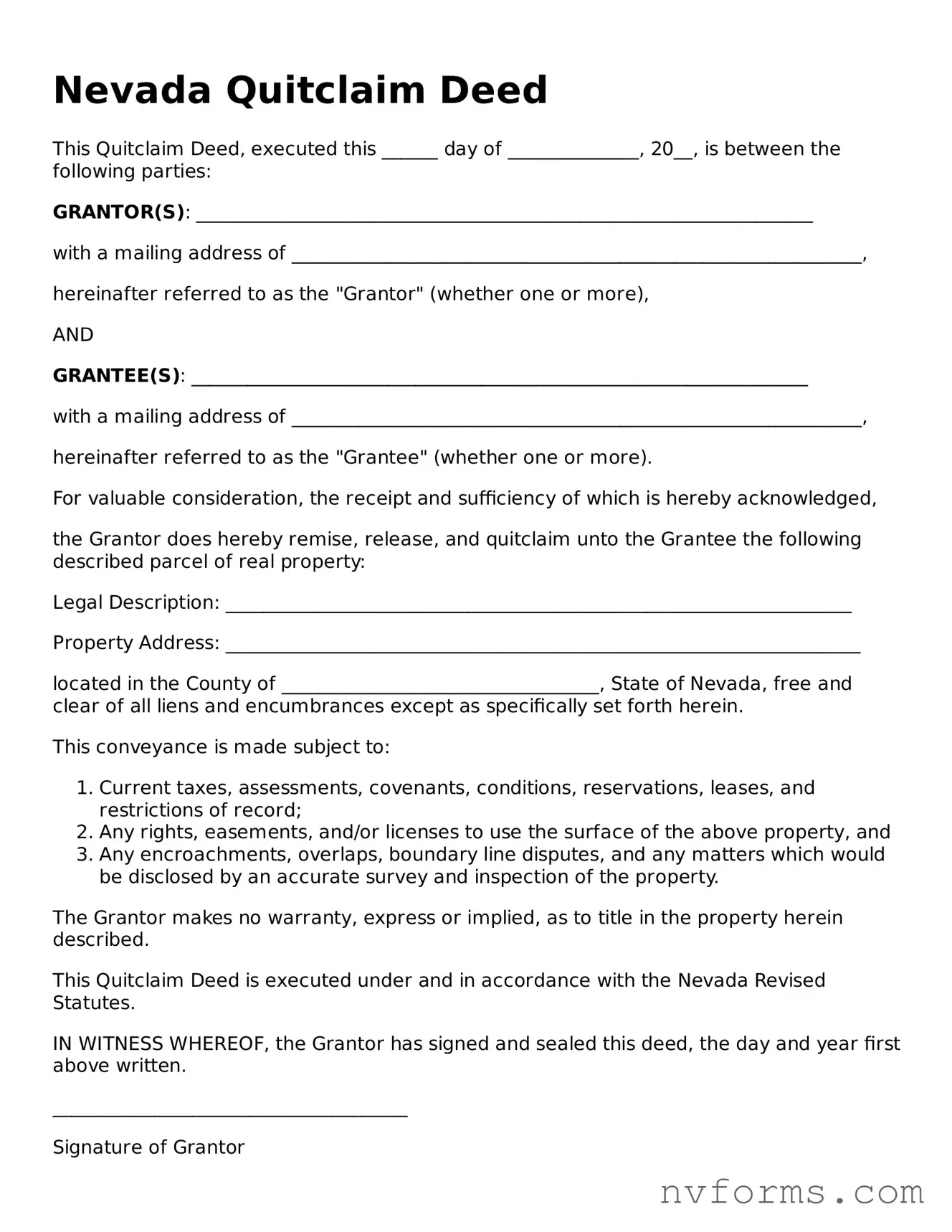

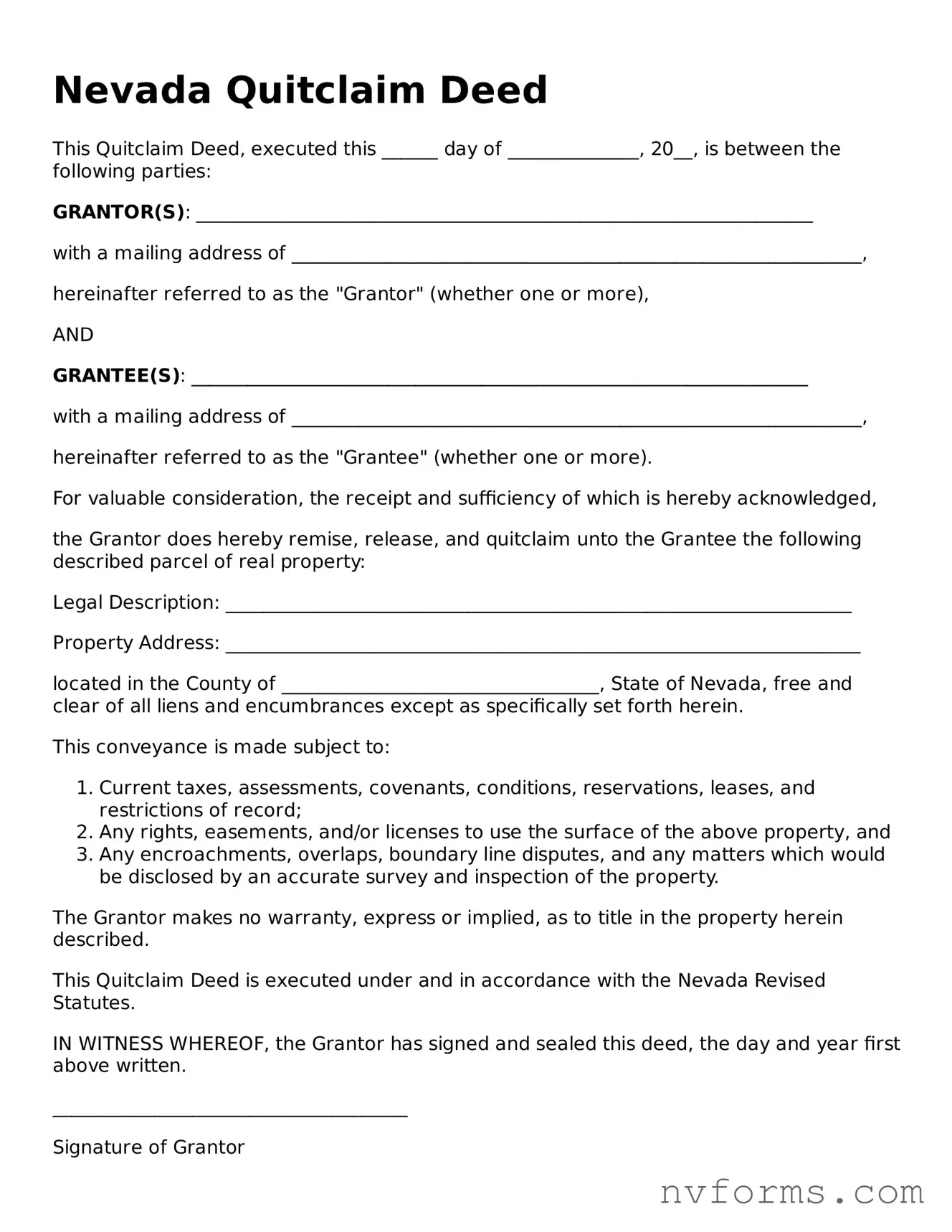

Nevada Quitclaim Deed

This Quitclaim Deed, executed this ______ day of ______________, 20__, is between the following parties:

GRANTOR(S): __________________________________________________________________

with a mailing address of _____________________________________________________________,

hereinafter referred to as the "Grantor" (whether one or more),

AND

GRANTEE(S): __________________________________________________________________

with a mailing address of _____________________________________________________________,

hereinafter referred to as the "Grantee" (whether one or more).

For valuable consideration, the receipt and sufficiency of which is hereby acknowledged,

the Grantor does hereby remise, release, and quitclaim unto the Grantee the following described parcel of real property:

Legal Description: ___________________________________________________________________

Property Address: ____________________________________________________________________

located in the County of __________________________________, State of Nevada, free and clear of all liens and encumbrances except as specifically set forth herein.

This conveyance is made subject to:

- Current taxes, assessments, covenants, conditions, reservations, leases, and restrictions of record;

- Any rights, easements, and/or licenses to use the surface of the above property, and

- Any encroachments, overlaps, boundary line disputes, and any matters which would be disclosed by an accurate survey and inspection of the property.

The Grantor makes no warranty, express or implied, as to title in the property herein described.

This Quitclaim Deed is executed under and in accordance with the Nevada Revised Statutes.

IN WITNESS WHEREOF, the Grantor has signed and sealed this deed, the day and year first above written.

______________________________________

Signature of Grantor

______________________________________

Printed Name of Grantor

State of Nevada

County of ___________________

On this, the ______ day of ______________, 20__, before me, __________________________________, a notary public in and for said state, personally appeared ________________________________________, known to me (or satisfactorily proven) to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged that he/she/they executed the same for the purposes therein contained.

In witness whereof, I hereunto set my hand and official seal.

______________________________________

(Notary Seal)

______________________________________

Notary Public Signature

My commission expires: _______________