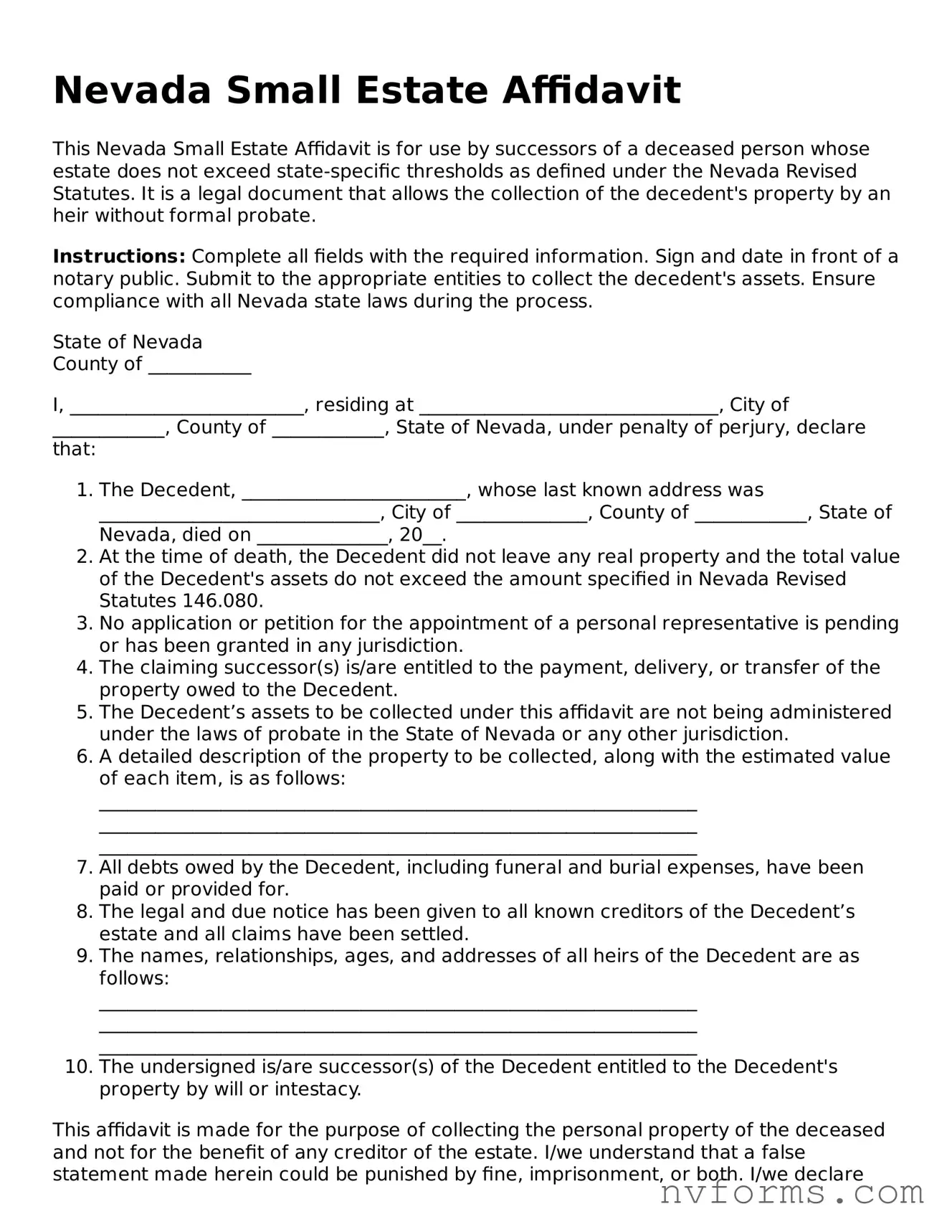

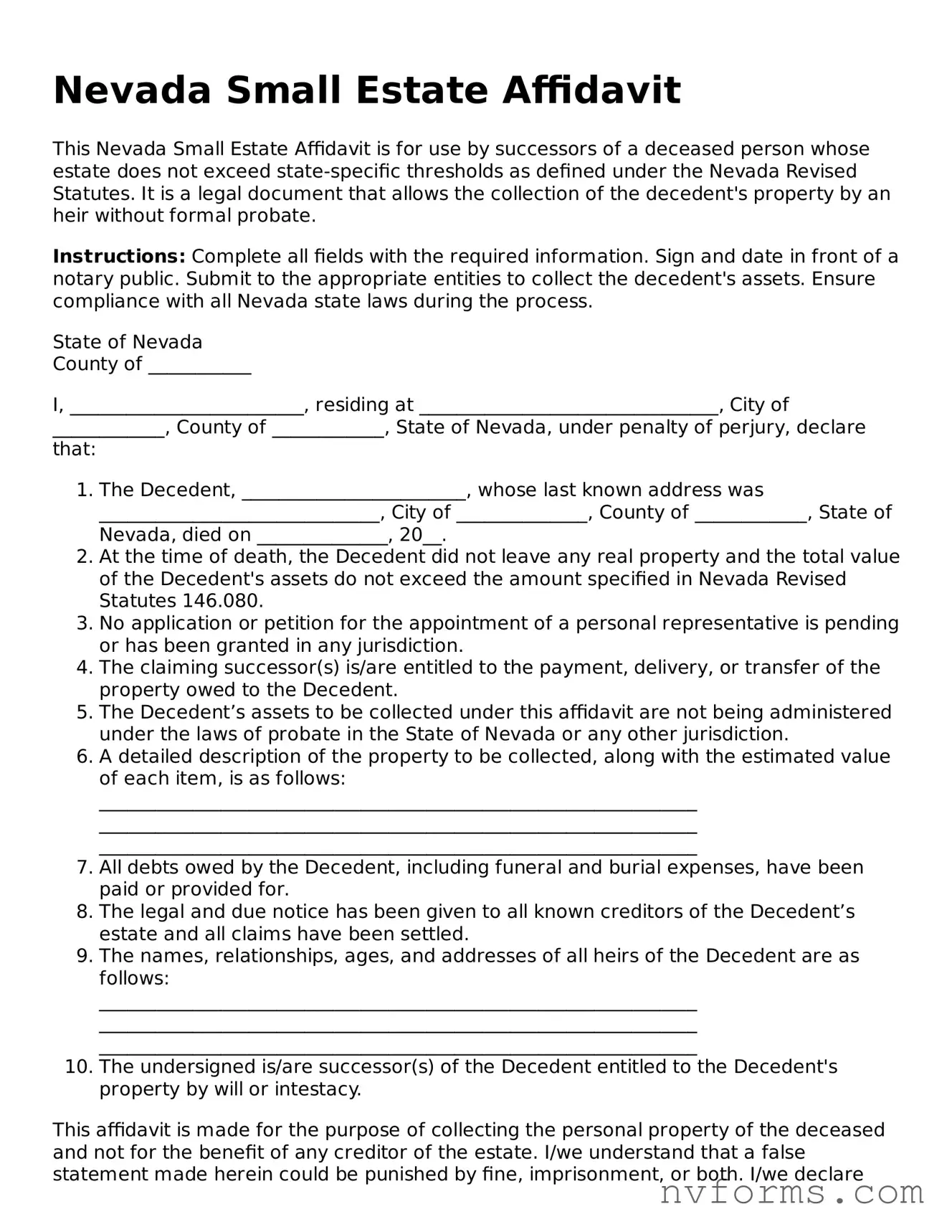

Nevada Small Estate Affidavit

This Nevada Small Estate Affidavit is for use by successors of a deceased person whose estate does not exceed state-specific thresholds as defined under the Nevada Revised Statutes. It is a legal document that allows the collection of the decedent's property by an heir without formal probate.

Instructions: Complete all fields with the required information. Sign and date in front of a notary public. Submit to the appropriate entities to collect the decedent's assets. Ensure compliance with all Nevada state laws during the process.

State of Nevada

County of ___________

I, _________________________, residing at ________________________________, City of ____________, County of ____________, State of Nevada, under penalty of perjury, declare that:

- The Decedent, ________________________, whose last known address was ______________________________, City of ______________, County of ____________, State of Nevada, died on ______________, 20__.

- At the time of death, the Decedent did not leave any real property and the total value of the Decedent's assets do not exceed the amount specified in Nevada Revised Statutes 146.080.

- No application or petition for the appointment of a personal representative is pending or has been granted in any jurisdiction.

- The claiming successor(s) is/are entitled to the payment, delivery, or transfer of the property owed to the Decedent.

- The Decedent’s assets to be collected under this affidavit are not being administered under the laws of probate in the State of Nevada or any other jurisdiction.

- A detailed description of the property to be collected, along with the estimated value of each item, is as follows:

________________________________________________________________

________________________________________________________________

________________________________________________________________

- All debts owed by the Decedent, including funeral and burial expenses, have been paid or provided for.

- The legal and due notice has been given to all known creditors of the Decedent’s estate and all claims have been settled.

- The names, relationships, ages, and addresses of all heirs of the Decedent are as follows:

________________________________________________________________

________________________________________________________________

________________________________________________________________

- The undersigned is/are successor(s) of the Decedent entitled to the Decedent's property by will or intestacy.

This affidavit is made for the purpose of collecting the personal property of the deceased and not for the benefit of any creditor of the estate. I/we understand that a false statement made herein could be punished by fine, imprisonment, or both. I/we declare under penalty of perjury under the laws of the State of Nevada that the foregoing is true and correct.

Date: ____________

Signature of Claimant: ________________________

Printed Name of Claimant: ________________________

State of Nevada )

County of _______________ ) ss.

Subscribed and sworn to (or affirmed) before me on this ____ day of ____________, 20__, by _______________________________, proved to me on the basis of satisfactory evidence to be the person(s) who appeared before me.

_____________________________________

Notary Public

My Commission Expires: ____________