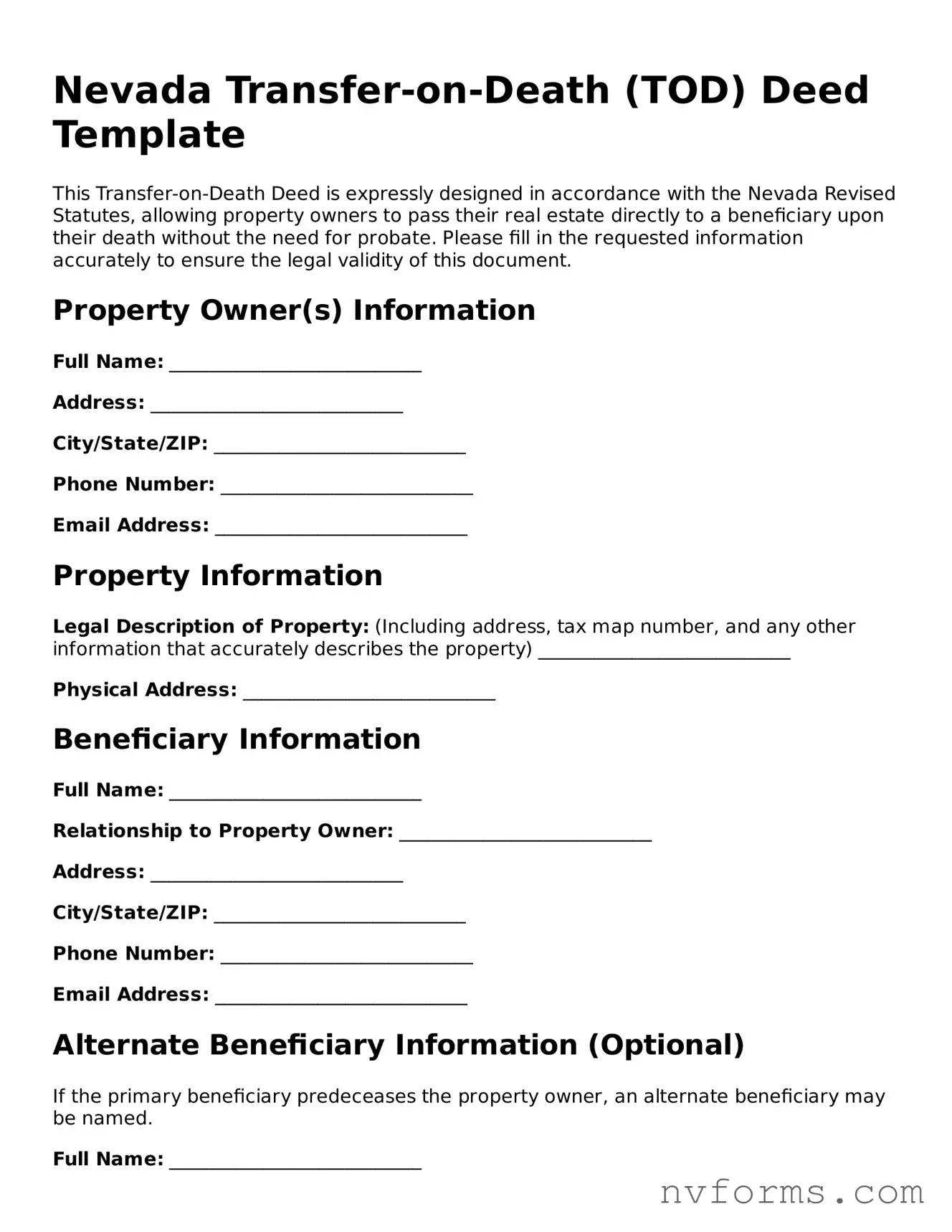

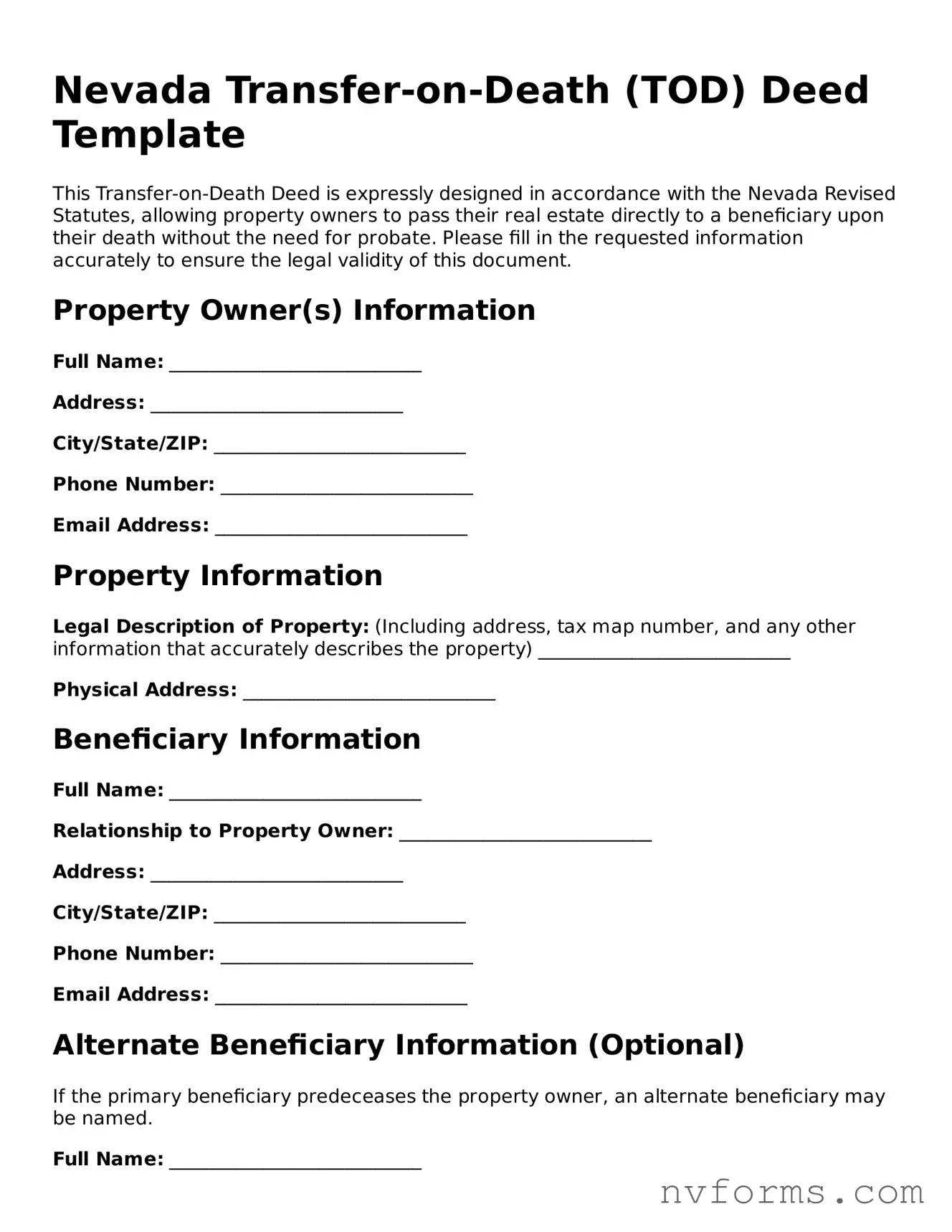

Free Transfer-on-Death Deed Form for Nevada

The Nevada Transfer-on-Death Deed form allows property owners to pass their real estate to beneficiaries without the need for a will or going through probate. By simply completing and recording this document, individuals can ensure that their property will directly transfer to their named beneficiaries upon their death. It stands as a straightforward means to manage estate planning, emphasizing the individual’s intent and simplifying the transfer process for loved ones.

Launch Editor

Free Transfer-on-Death Deed Form for Nevada

Launch Editor

Launch Editor

or

⇩ Transfer-on-Death Deed File

Don’t stop now — finish the form

Finish Transfer-on-Death Deed online using an easy step-by-step flow.